West Africa’s Tourism Recovers Slowly During COVID-19

——Overview of The Gambia

by Wu Yuliang from UESTC

(作者:电子科技大学西非研究中心团队,执笔人:吴宇亮(电子科技大学西非研究中心助理)【西非漫谈】2022年第三期,总第五十二期。整理:张海琳、孟雅琪,供稿:赵蜀蓉)

--本文原刊载于环球网(Huanqiu.com)“西非漫谈”栏目

链接:https://opinion.huanqiu.com/article/46uLGwt4ZKk

In the expectation of the sustainable economic and social development of West African countries, achieving the goals of UN Agenda 2030 and the AU Agenda 2063 are not predestined. Countries in the region, including The Gambia, have to face many risks and challenges. Over the past two years, COVID-19 spread rapidly around the world, including in West Africa. But COVID-19 may be just part of all the challenges they face. According to Johns Hopkins University Center for Systems Science and Engineering (JHU CSSE) data, as of 31 January 2022, there were 824,419 confirmed cases of COVID-19 in the region, with 10,883 deaths (case fatality rate 1.31%). The coronavirus has had a major impact on tourism in West Africa.

FIGURE 1: Covid-19 fatality rate in 15 West African countries

The outbreak in West Africa has gone through two main stages. Figure 1 shows that dynamic downward trend in Covid-19 case fatality rates from March 2020 to January 2022 in West Africa. Overall, the first stage was also the stage with the 15 countries experienced their highest case fatality rates in the early stages of the COVID-19 outbreak (March-June 2020). The case fatality rate in the Gambia, Cape Verde (33.33%), Nigeria (23.08%) were once more than 20% at this stage. Meanwhile, The Gambia also recorded the highest case fatality rate of 50% on March 23, 2020. From the second stage, the spread of the virus in West Africa was beginning to be contained. After reached 10.04% in Liberia on May 29, 2020, the regional case fatality rate has never rebounded above 10% and has continued to decline.

West Africa comprises 15 countries, which half of the countries in the region are classified as fragile and face a multiplied burden from the coronavirus, which could undermine development, peace, and social stability. After experiencing GDP growth of 3.4% in 2018 and 3.6% in 2019, West Africa’s GDP contracted-1.5% in 2020 because of COVID-19, this is far below the 4% predicted growth rate before COVID-19 by African Development Bank (AfDB).

Many West African countries have been hit hard by the pandemic. The Gambia's tourism industry has gone from boom to bust between 2020 and 2021. The country saw its first COVID-19 case on March 17, 2020 as a Gambian returned from the United Kingdom, then the President declared a precautionary state of emergency starting from March 27 2020 which saw the closing of all non-essential businesses, airspace, and land borders.

(From: https://www.gambia.co.uk/mandina-lodges)

As a member of ECOWAS, The Gambia, like other countries in the region, has adopted some stimulus policies. Due to the country rapid economic downturn, financial constraints and high unemployment. The government has decided to relax restrictions on tourism during 2021 travel season, this is undoubtedly a “tonic” for The Gambia's tourism industry since the COVID-19 outbreak, and will be an effective incentive policy for the tourism sector to get out of the difficult situation.

Chapter 2 - The Gambia has abundant tourism resources

2.1 The Gambia is known as ‘the Smiling Coast of Africa’. Tourism in The Gambia has become the fastestgrowing sector of the economy as visitors coming in every year are drawn by its beaches, birds, sunshine, culture, the friendliness and hospitality of The Gambian people along with the peace, security and political stability of the country.

(From: https://www.gambia.co.uk/sunbeach-hotel?oo=false&back=true)

The Gambia has many distinctive tourist attractions. This smallest country on the African continent features golden beaches backed by swaying palms, scenic lagoons, sleepy fishing villages, and teeming wildlife—includingchimpanzees, hippos, crocodiles, and nearly 600 bird species. In 2019, Gambia won Tourism Destination of the Year Award organized by the German travel channel Sonnenklar.tv. The Gambia also honored 2019 and 2020 Ethical Destinations Award organized by Ethicaltraveler. These achievements also benefit from the continuous self-improvement and self-supervision of government departments and industry institutions, especially the establishment of the Gambia Tourism & Hospitality Institute (GTHI), which is committed to strengthening the capacity building of tourism workers and promoting the sustainable development of the Gambia's tourism industry.

2.2 Comparative advantages of tourism in The Gambia.The Gambia’s comparative advantage is its proximity to Europe, all year-round tropical weather, English speaking populace, low prices, relative peace and stability.

Under the guidance of the government and the leadership of the industry, the market competitiveness of The Gambia’s tourism products has been continuously improved. A series of marketing and promotional activities were undertaken to increase the destination’s footprint on new and old source markets. Many tourists arrive from the United Kingdom and the Netherlands with new markets emerging such as Germany, Poland, Russia, Portugal and Turkey (UNDP, 2020).

Several initiatives were undertaken to attract more investors including free land allocation within the tourism development area (TDA), Special Investment Certificates (SICs) such as tax holidays and the organization of an international investment forum. A new international conference center has also been opened (CHINA AID).

(From: https://www.visitthegambia.gm/gallery/17736854627d4c7c5d897d7e0963f451d8ddb340bf.jpg)

2.3 Climatic conditions in The Gambia. The Gambia has two distinct seasons: Wet and Dry Season. The Wet Season is characterized by rains and is usually short from June to October, with most of the precipitation falling within an hour or less. The Dry Season ranges from November to May and during this period, thousands of tourists come to this country for their holiday. The country enjoys virtually uninterrupted sunshine and high daytime temperatures with almost no rainfall from November to May. Average daytime temperatures is 27°C (80°F), and average nighttime temperatures is 20°C (68°F).

2.4 Easy and convenient to The Gambia. Banjul International Airport is the only airport in The Gambia, located in Yundum about 24 km from capital city Banjul. The airport has some schedule flights include Air France, Brussels airlines, Vueling Airlines, Air Turkey, Royal Air Maroc. In addition, in order to improve the tourist carrying capacity, there are also some charted/none schedule carriers include Thomas Cook, Corendon, TUIHoll and Transavia.

Chapter 3 - The Contribution of Tourism to the economy

3.1 Contribution to GDP of The Gambia. According to UNDP brief report (2020), it is not difficult to find that tourism is one of the pillar industries of national development. The annual output value contributes more than 20% to the national GDP (20.8%). Moreover, it also provides over 42,000 direct jobs and 40,000 indirectly for the country. Tourism is the main sector of the country’s foreign exchange inflow. It generates about $85 million foreign exchange earnings and attracted over $45 million in FDI between 2015-2019.

3.2 Contribution to tourism workers’ income. According to an assessment conducted by GBoS (2020), the respondents were asked about average monthly income during the peak season. The results show that the tourism industry can bring very considerable income to the workers. Correspondingly, the sustainable development of the tourism industry and the steady flow of tourists will bring stable income to the tourism workers, which is a contribution to the development of the people's livelihood in Gambia. The highest were bird watchers, who reported an average monthly earnings of GMD52,102 (approximately $1043), followed by taxi drivers (GMD 37,508) and craft market vendors (GMD 37,553).

3.3 Per capita consumption of tourists. According to UNDP statistics (2020), the average spending per tourist to The Gambia is $924 and it is very important to note that the out of pocket expenditure directly benefits local businesses, particularly in the tourism sector (restaurants, bars, nightclubs), which does not include expenditures on accommodation, airport and transfers.

3.4 Tourism would likely have developed without COVID-19. Benefited from the government attaches great importance to the development of tourism, tourism industry association standardized and orderly, excellent tourism atmosphere and other favorable factors, the competitiveness of The Gambia's tourism industry has improved significantly in recent years. Before COVID-19 outbreak, tourism has maintained a high growth rate, which has been highly praised by the International Community. Relevant agencies forecast the development of tourism in The Gambia as follows:

Short-term goals for tourism development. The Gambia Tourism Board had targeted an increase in tourist arrivals in 2020 with the expectation being 289,000 air arrivals, an increase of 22.6% over the 235,710 arrivals in 2019. This target will be impossible to reach now with the virus and even worse news it that there would be no tourists arrivals at all if the pandemic continues and is not contained. Besides above, the government should recognize the problems and difficulties faced by the tourism industry, and must increase actual support, such as fiscal policy, monetary policy and other direct measures. Ultimately, there is need for enormous support to keep the tourism sector alive and work on recovery plans once the pandemic is contained.

Long-term goals for tourism development. The World Travel and Tourism Council has made positive prediction about the contribution of tourism to The Gambia’s economy:

• GDP: Direct contribution to rise by 2.5% per annum from 2014-2024.

• GDP: Total Contribution to rise by 3.9% per annum from 2014-2024.

• Employment: Direct contribution to rise by 0.2% per annum to 5.2% of total employment in 2024.

• Employment: Total Contribution of tourism to employment including jobs indirectly supported by the industry to rise by 1.5% per annum to 144,000 jobs in 2024 (15.4% of total jobs).

• Visitor exports: to grow by 1.2% per annum to 2024, contributing 45.6% of total exports.

• Tourism investment: to rise by 8.2% per annum to 2024, contributing to 14.9% of total investment.

Chapter 4 - The impact of the virus on tourism

4.1 The impact on the world. The sudden outbreak of the virus is like suddenly pressing a pause button for people all over the world. When WHO declared the COVID-19 virus a global pandemic, that decision was destined to affect all industries around the world. One of the hardest hit is however the tourism industry, due to the restriction on the movement of people globally.

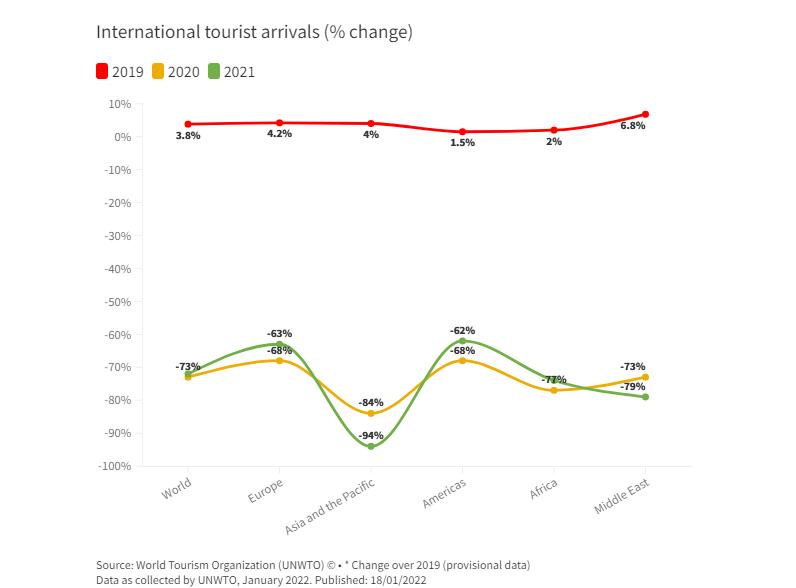

COVID-19 has totally changed the way people travel, especially international travel. According to UNWTO data (2022), 2020 is the worst year on record for tourism, when international arrivals decreased by 73%. The virus has severely delayed the development of international tourism. Fortunately, global tourism experienced a 4% upturn in 2021, compared to 2020 (415 million versus 400 million). However, international tourist arrivals (overnight visitors) were still 72% below the pre-pandemic year of 2019. Despite an uptick in arrivals numbers in 2021, the trend towards increased tourism demand and international tourism remains fragile. Moreover, the impact of the Omicron variant and surge in COVID-19 cases is yet to be seen.

Direct economic losses to the global tourism industry. Global tourism is showing signs of recovery, but the outlook remains uncertain. According to the United Nations World Economic Situation and Prospects (WESP) 2022, the global economic recovery is facing significant headwinds during COVID-19 infections, which the impact of the pandemic beyond the sector itself.

Slow and uneven recovery. Figure 2 shows that the pace of recovery remains slow and uneven across world regions due to varying degrees of mobility restrictions, vaccination rates and traveler confidence. Europe and the Americas recorded the strongest results in 2021 compared to 2020 (+19% and +17% respectively). Meanwhile, Africa saw a 12% increase in arrivals in 2021 compared to 2020, though this is still 74% below 2019.

FIGURE 2: International tourist arrivals (% change) by UNWTO

(From:

https://app.flourish.studio/visualisation/8478714/edit?)

4.2 The Gambia has suffered a recession. There is literally a total shutdown in the tourism industry, which has significant negative socio-economic impact on all sectors and the economy as a whole - given that tourism’s important contribution to both employment and GDP (GBoS, 2020).

Intuitive data: The rapid decrease in tourists, tourism industry almost completely closed. According to African Development Bank Data (AfDB), The Gambia has foregone around 150,000 tourists during COVID-19 in 2020 alone. At $1,000 expenditure per tourist roughly, this amounts to lost revenue of approximately $150 million, roughly half of which would go to The Gambia’s final output. Figure 3 shows that no tourists arrived into The Gambia by air in April 2020. Subsequently, as major economies around the world launched mass vaccination programmes for their populations, tourist arrivals to The Gambia showed an increasing trend in the winter of 2020 and 2021 with a monthly peak of nearly 10,000 arrivals, but still less than a third of the 2019 peak of 32,209 arrivals.

Tourist arrivals have fallen from more than 235,710 in 2019 to less than 90,000 in 2020. The Gambia Bureau of Statistics (GBoS) has published a rapid assessment, about 69% of respondents had closed their businesses, which forecast an overall amount of GMD6.8 billion (approximately $136 million) by all tourism-related establishments will be lost. In fact, the actual losses in The Gambia far exceeded this figure.

According to GBoS data (2021), the country’s real GDP growth was strong before the outbreak of COVID-19. The Gambia’s economy grew by 7.2% and 6.2% for 2018 and 2019 respectively. However, real economic growth contracted to -0.2% in 2020 owing to the disruption of the pandemic.

FIGURE 3: Monthly Tourist Arrivals, January 2011 to September 2021

Source: The Gambia Bureau of Statistics (GBoS).

https://gambia.opendataforafrica.org/gtfztdf/tourist-arrivals

For the monthly data, there were 7,147 international tourist arrivals (overnight visitors) in September 2021, which dropped by 37.52% compared to the same period of pre-pandemic year 2019 (11,439). In the same situation, the number of arrivals in September 2020 was only 984, a sharp drop of 91.40% compared to 2019. During the dry season , there were 7,691 international tourist arrivals (overnight visitors) in December 2020, which dropped by 76.12% compared to the same period of pre-pandemic year 2019 (32,209).

Data analysis from Google: Global searches for item of “The Gambia” and “travel” are both continued to decline. Google trend search weekly data on The Gambia’s tourism (Figure 4) highlights a downward trend in tourism search to The Gambia between January 2019 and December 2021. Despite there has been a gradual increase in interest since April 2020, but it remains low and highly volatile. Moreover, it is reliant on international travel returning and The Gambia’s restrictions on international tourism relaxing to levels which travelers find acceptable. An index base of 100(reference data, 2019) indicates the highest level of GoogleSearch interest, and an index value of 50 indicates that the week of search interest is half that of the week of highest search interest.

FIGURE 4: Google Tourism Search for The Gambia, January 2019 - December 2021.

Source: Google Search Trend Popularity Index

Note: Reference line is the first week of 2019. “The Gambia” term searched.

Chapter 5 - Response measures in The Gambia

5.1 Measures taken by the government. From October 1, 2021, in order to promote the recovery and development of tourism, all visitors with proof of being fully vaccinated shall be allowed to enter The Gambia without a PCR Test Certificate, they shall not be subjected to a rapid test or be quarantined upon arrival. The government of The Gambia with its ardent desire to open up the country for the 2021/ 2022 Winter Season. This policy is the main direction of the government's COVID-19 management policy at this stage.

5.2 Measures taken by the tourism industry in response. According to a GBoS assessment (2020), a total of 266 establishments surveyed in the sector. Of the 266 companies surveyed, there were 55 restaurants (20.7%), 32 hotels (12%), 32 guesthouses (12%), Lodges and Eco lodges (9.4%). Out of the 266 establishments, 167 had to reduce the working staff as a measure to mitigate the impact of Covid-19 while 68 have reduced the payment of their retained staffs as shown in Figure 5.

Figure 5: Measures to mitigate the impact of Covid-19 by tourism establishments

Source: A Rapid Assessment by The Gambia Bureau of Statistics (GBoS)

Chapter 6 - Recommendations for The Gambia to resume tourism

The first 2022 issue of the UNWTO World Tourism Barometer indicates that rising rates of vaccination, combined with easing of travel restrictions due to increased cross-border coordination and protocols, have all helped release pent up demand. Meanwhile, according to the survey from AfDB (2021), with travel restrictions still salient, the sector needs to be supported to avoid long-term capacity loss. The recommendations for The Gambia are as follows:

6.1 Take measures to attract more tourists. The government should increase financial and technical support for tourism, promote the organic connection between domestic and regional tourism markets, and reduce the adverse impact of the international market. Gambian authorities should aim to minimize the restrictions to this end as far as is possible whilst maintaining appropriate health and safety protocol. The government needs to attract more African tourists and seek help from UNCTAD and the UN Economic Commission for Africa (UNECA). Tourism firms and organizations should look to increase local demand for tourism by offering more quality products.

6.2 Transformation and upgrade, increase high-end tourism projects. In the past, The Gambia was dominated by beach holidays; In the future, diversified high-end eco-tourism projects such as wildlife experience and natural and cultural heritage exploration can be built to raise the price of tourism services and reduce the adverse impact of summer and the epidemic. This requires large investments in skills and infrastructure. Partnerships with other African tourism boards who have successfully developed these industries, such as Rwanda, Uganda, Kenya, and Tanzania could be highly beneficial. Birdlife (Makasutu Culture Forest) and chimps are two potential entry points for The Gambia into the higher value-added offerings.

6.3 Strengthen coordination and boost investment promotion. The government should step up marketing efforts for tourism, introduce more competitive business policies, encourage capital inflows, adjust the structure of investment tax incentives, and provide investors with substantial tax holidays to maximize their expected returns. At the same time, strengthen coordination with regional countries, improve the convenience of foreign investors, urge them to develop more tourism products with local characteristics; Promote the establishment of regional market operation initiative to reduce the unnecessary competition among countries in the region. Any non-coordinated policies will ultimately lead to the consequences of harming others and not benefiting themselves, thus weakening the competitiveness of regional tourism.

The world is now two years into the COVID-19 pandemic, and the end is nowhere in sight. Against this backdrop, the risk of new COVID-19 variants emerging and spreading threatens to derail.The important role that tourism will play in the recovery of national economies and global trade has been highlighted in the 2022 edition of the World Economic Situation and Prospects (WESP). In contrast, African countries, including The Gambia, which are highly dependent on tourism, are facing a more difficult and long road to economic recovery:

7.1 The Gambia has experience in dealing with tourism emergencies. Tourism sector has been affected by several external and domestic shocks most recently the Ebola crisis of 2014 and the political impasse of 2016. Even so, tourism had started to rebound in 2019 with tourist arrivals rising from 203,643 tourists in 2018 to 235,710 in 2019, a final net increase of 15.7%.

7.2 Cautiously optimistic about the recovery of The Gambia’s tourism. Some travel analysts say the country will once again have a tourism boom. Though there are still obstacles ahead, they believe that in 2023-2024, with the continuous implementation of vaccines and effective and scientific global virus prevention, the global pandemic will reach a significant turning point or watershed, and The Gambia will be able to share this achievement. The tourism industry will be able to make a new start and continue to bring happiness to the people of the country. The continental smallest country will once again give the world the charm of ‘the Smiling Coast of Africa’.

7.3 The virus continues to mutate, adding much uncertainty to the future. Despite recent improvements, demand for travel could be further affected by uneven vaccination rates around the world and new COVID-19 strains which had prompted new travel restrictions in some countries. In the past few months, the emergence of the Omicron variant has led dozens of countries to reinstate restrictions on arrivals, creating new uncertainty for travelers. No one knows for sure when tourism will fully recover, and perhaps the timing of a full recovery in the West Africa remains unpredictable. Perhaps we will have to wait until the end of the COVID-19.

This article aims to introduce readers to the challenges and risks facing the tourism industry in West Africa at this stage. If before the outbreak, the West African tourism development relied on natural geographical advantages and relatively low tourism prices. When COVID-19 is over, it mainly relies on continuous transformation and upgrading, creating a unique tourism cooperation system and developing tourism products with high added value, this will be the foundation for the West Africa’s tourism to take off again.

What is described in this article is mainly a comprehensive overview of the projections and reports of UN, AU, AfDB and other agencies on West African countries, especially The Gambia, will struggle for the slow recovery of tourism against COVID-19. Let us continue to track the recovery of tourism in West African countries, including The Gambia.

[1] See IMF Policy Tracker, accessed 17 May 2021.

https://www.imf.org/en/Topics/imf-

and-covid19/Policy-Responses-to-COVID-19

[2] Coronavirus pandemic could cost global tourism $2 trillion this year. UN, 2021.

https://news.un.org/en/story/2021/11/1106712

[3] Covid-19 fatality rate in 15 West African countries. ourworldindata, 2022.

https://ourworldindata.org/explorers/coronavirus-data-explorer

[4] GMB-COVID-19-Situational-Report, MOH, The Gambia, 2021.

https://www.moh.go

v.gm/covid-19-report/?fbclid=IwAR3QFGlZGpng7yltfzqR5JukuO0m2AlxmD_GrI7la2YW9OAKXQHiA1l04l8

[5] World Economic Situation and Prospects 2022. UN, 2021.

https://www.un.org/develo

pment/desa/dpad/wp-content/uploads/sites/45/publication/WESP2022_web.pdf

[6] TOURISM GROWS 4% IN 2021 BUT REMAINS FAR BELOW PRE-PANDEMIC LEVELS, JAN 2022.

https://www.unwto.org/taxonomy/term/347

[7] This paragraph is based on a recent 2021 AfDB The Gambia country note.

https://www.afdb.org/pt/documents/gambia-assessing-impact-covid-19-gambia-and-spending-needs-2030-sdg-agenda

[8] THE ECONOMIC CONTRIBUTION OF TOURISM AND THE IMPACT OF COVID-19.UNWTO,2021.

https://www.e-unwto.org/doi/epdf/10.18111/9789284423200

[9] Artal-Tur, Pallardo-Lopez and Requena Silvente. 2016. Examining the impact of visa restrictions on international tourist flows using panel data. Estudios de Economia 43 (2):265-279. Available:

https://www.researchgate.net/publication/311647205_Examining_the_

impact_of_visa_restrictions_on_international_tourist_flows_using_panel_data

[10] Burrington. 2020. A beach lover’s paradise. The Gambia Experience.

https://www.gambia.co.uk/blog/a-beach-lovers-paradise

[11] Gambia: intra-Africa trade and tariff profile 2020.

https://www.tralac.org/resourc

es/infographic/15010-gambia-intra-africa-trade-and-tariff-profile.html

[12] The African Continental Free Trade Area: Potential Economic Impact and Challenges.

https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2020/05/13/T

he-African-Continental-Free-Trade-Area-Potential-Economic-Impact-and-Challenges-46235

[13] Informal economy: a hazardous activity. ILO.

https://www.ilo.org/safework/are

asofwork/hazardous-work/WCMS_110305/lang--en/index.htm

[14] COVID-19 crisis and the informal economy: Immediate responses and policy challenges. ILO, 2020.

https://www.ilo.org/wcmsp5/groups/public/---ed_protect/---protrav/---

travail/documents/briefingnote/wcms_743623.pdf

[15] First tranche of COVID-19 vaccines arrives in The Gambia via the COVAX initiative. UNICEF, 2021.

https://www.unicef.org/wca/press-releases/first-tranche-covid-19-v

accines-arrives-gambia-covax-initiative

[16] The tourism sector in the context of COVID-19 outbreak in The Gambia. Brief #02. UNDP, 2020.

https://www.undp.org/content/dam/rba/docs/COVID-19-CO-Response/Soc

io-Economic-Impact-COVID-19-Tourism-Gambia-Policy-Brief-2%20-UNDP-Gambia-April-2020.pdf

[17] TOURIST ARRIVALS DOWN 87% IN JANUARY 2021 AS UNWTO CALLS FOR STRONGER COORDINATION TO RESTART TOURISM.

https://www.unwto.org/new

s/tourist-arrivals-down-87-in-january-2021-as-unwto-calls-for-stronger-coordination-to-restart-tourism

[18] INTERNATIONAL TOURISM AND COVID-19, UNWTO.

https://www.unwto

.org/international-tourism-and-covid-19

[19] Must see attractions in The Gambia. Lonelyplanet.

https://www.lonelyplanet.com

[20] The World’s Ten Best Ethical Destinations 2021: Special COVID-19 Edition. Ethical Travel, 2021.

https://ethicaltraveler.org/reports/destinations/the-worlds-ten-best-ethica

[21] The Gambia wins Tourism Destination of the Year Award. Gambiana, 2019.

https://gambiana.com/the-gambia-wins-tourism-destination-of-the-year-award

[22] BIRD WATCHING HOLIDAYS. The Gambia Experience.

https://www.gambia.

co.uk/holiday-ideas/birdwatching-holidays?source=ideas

[23] About The Gambia. The Gambia Tourism Board.

https://www.visitthegambia.gm/all-about-gambia

[24] SUMMER HOLIDAYS. The Gambia Experience.

https://www.gambia.co.uk/hol

iday-ideas/summer-holidays?source=ideas

[25] Small States: Fighting the Pandemic, Focusing on Solutions .

https://www.world

bank.org/en/news/feature/2021/09/23/small-states-fighting-the-pandemic-focusing-on-solutions