(作者:电子科技大学西非研究中心团队,执笔人:Evans Opoku-Mensah(西非研究中心助理) 【西非漫谈】2022年第九期,总第五十八期。译者:陈思雨(外国语学院);整理:孟雅琪(公共管理学院);供稿:电子科技大学西非研究中心团队)

--本文原刊载于环球网(Huanqiu.com)“西非漫谈”栏目

链接:https://opinion.huanqiu.com/article/48B6P58MK8K

The primary objective of the Bank of Ghana is to maintain stability in the general level of prices, as stated under section 3 of the Bank of Ghana Act 2002, (Act 612), as amended. In addition to price stability, the Bank is enjoined to support the general economic policy of the Government, promote economic growth and development, and ensure effective and efficient operation of the banking and credit system; and contribute to the promotion and maintenance of financial stability.

The main policy tool employed by the MPC is the Monetary Policy Rate (MPR), which signals the stance of monetary policy and anchors short-term market interest rates to achieve the primary objective of price stability. In exceptional times and under unusual circumstances, the MPC may announce additional macroprudential policy measures in addition to its regular interest rate decision. These measures usually involve the utilization of other monetary policy tools at the disposal of the Central Bank, such as moral suasion and macroprudential measures. These instruments may be deployed to address perceived structural bottlenecks to current policies to avoid burdening the extent of use of the MPR which may have unintended consequences on the real economy.

Key Features of the Implementation Framework

At the operational level, the key strategy is to help implement MPC decisions regarding changes in the Monetary Policy Rate (MPR) and introduce operating procedures to support the development of monetary policy transmission. The MPR signals the monetary policy stance, and it is the rate at which short-term monetary policy operations are conducted with counterparties – mainly, the commercial banks, on a day-to-day basis and also performs the function as follows:

i. Market Operations and the Interest Rate Corridor: The Bank of Ghana uses an interest rate-oriented monetary policy operation. Thus, the bank determines its policy rate, the MPR, and keeps the overnight interbank rate closely aligned with the policy rate using its policy instruments)

ii. Repo Operations: The major tool that the Bank of Ghana uses to defend the Monetary Policy Rate (MPR) is through the overnight repo and reverse repo facilities. The Financial Markets Department (FMD) of the Bank operates an Interest Rate Corridor (IRC) system to ensure that overnight rates remain in line with the MPR, reduce the volatility of overnight interest rates, and eliminate any chance of persistent swings of market rates.)

iii. Open Market Operations: The Financial Markets Department (FMD) conducts weekly open market operations by auctioning Bank of Ghana securities)

iv. Term Deposit: The FMD also operates the 7-Day Term Deposit instrument for banks with persistent excess liquidity over three days.

v. Foreign Exchange (FX) Operations (The multiple-price forward FX auction aims to improve price discovery, deepen the FX market, and reduce uncertainty about the future availability of FX to meet the needs of banks' clients

Policy Rate

Key rate announced by the Bank of Ghana has undergone various transformations and changes. The rate is a signaling rate that is supposed to serve as a reference cap for all other rates in the economy. The lending rate to the commercial bank was 16% in February 2010 and 14.5 in December 2021. During the said period, the policy rate reached its highest peak in 2015 and 2016

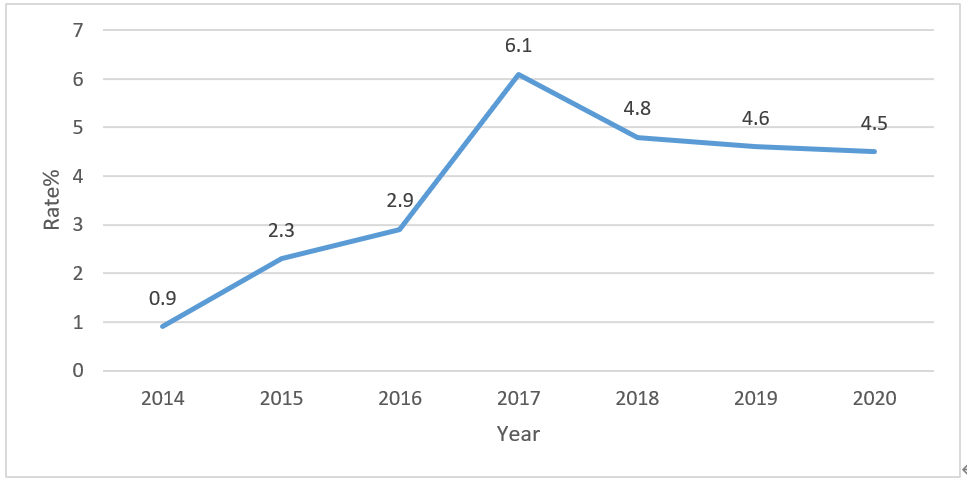

Figure 1 Trend of Ghana Policy Rate

Agriculture Sector

Regarding the sector's contribution to the GDP, as seen in the table (Agriculture Sectors Contribution (%) to GDP), it has been increasing since 2014. From 0.9% in 2014, it has increaed to 4.5% as of the third quarter of 2020. This sector does not only contribute to Ghana's GDP but also absorbs a lot of labor forces and then provides raw materials for industrial growth and development. Within this period, the Ghanaians has initiated the planting for food and jobs.

Planting for Food and Jobs is a flagship agricultural Campaign of the Government, with five (5) implementation modules. The Five Modules of the planting for food and job has been

(i) Food Crops PFJ (Crops). This aims to promote food security and immediate availability of selected food crops on the market and also provide jobs.

(ii) (ii) Planting for Export and Rural Development (PERD)

(iii) Greenhouse Technology Villages (3 Villages)

(iv) Rearing for Food and Jobs ( RFJ)

(v) Agricultural Mechanization Services (AMSECs)

To attain a higher increase in agricultural GDP, the Ghanain Government seeks to modernize agriculture, improve production efficiency, achieve food security, and profitability for our farmers. The Government also seeks to pursue a value-addition strategy, aimed at rapidly ramping up agro-processing and developing new and stable markets for our products. These policies and interventions will ensure that our farmers and fisherfolk earn higher incomes as it will encompass the full agricultural value chain and create additional businesses and job opportunities in the areas of storage, transport, processing, packaging and marketing of agricultural produce. Local assemblies and traditional authorities are assigned specific roles targeted at supporting women in agriculture.

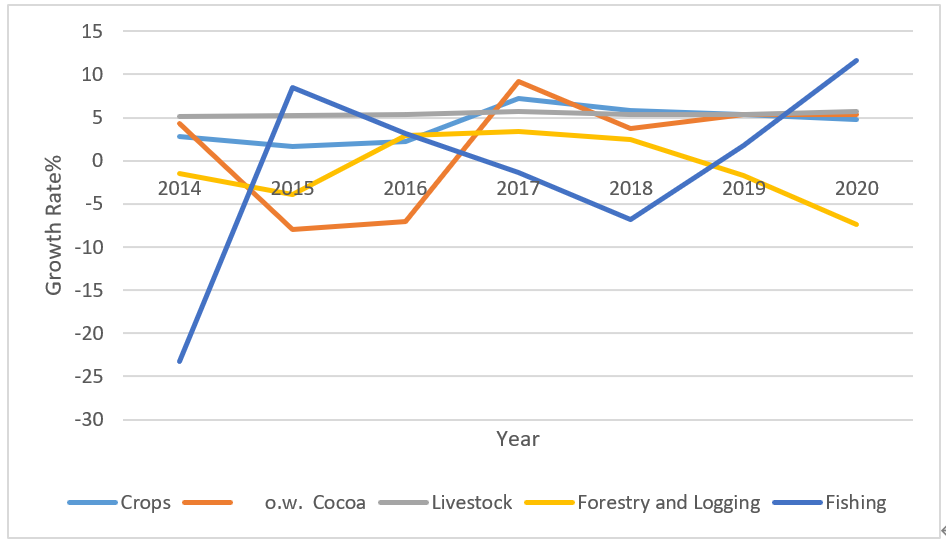

Figure 2 Trend of Agricultural growth

Agricultural Sub-sector contribution to GDP

The Ghanaian agriculture sector is sub-divided into crops, cocoa, livestock, forestry, logging, and fishing. The growth of each of these sectors has been undulating since 2014. As of the third quarter of 2020,the Fishing subsector had the best average growth performance of 11.6 percent, representing a substantial turnaround from the contraction of 1.1 percent recorded over the same period in the previous year. The Livestock sub-sector followed this with 5.7 percent, and the Crops subsector with 4.8 percent. However, the Forestry and Logging subsector contracted by an average of 7.4 percent over the period. The growth in the cocoa subsector is particularly interesting since this sector is very important due to the large number of people that sector employs and the amount the count amount of foreign exchange the country obtains from the sector.

Figure 3 Sub-Sector of the Agricultural industry

INDUSTRY

Given the contribution it makes to GDP, the industrial sector continues to support the growth of the Ghanaian Economy. Industrial sector products are also crucial foreign exchange-earners. The sector also fulfills almost all of the nation's power and water requirements at the household and industrial level. Since independence, Ghana has undergone three major industrialization episodes: the inward over-protected ISI strategy of 1960-83; the outward liberalized strategy during 1984-2000; and since 2001, the private sector-led accelerated industrial development strategy.

I. Inward over-protected ISI strategy (1960-83): Import substitution industrialization through high levels of effective protection with:

· Reliance on large-scale public sector investment as the leading edge of industrial development. Application of quantitative import restrictions and import tariffs to protect and support the ISI strategy during the 1960s-early 1970s;

· Extensive use of administrative controls to determine incentives and allocate resources for industrialization (introduced in 1962, but extensive use from the beginning of the 1970s to 1983).

II. Outward liberalized industrialization strategy (1984-2000): Industrial restructuring under the SAP/ERP was to create an internationally competitive industrial sector based on highly efficient import substitution and increased export approach supported by:

· Removal of price and distribution controls, abolishing of import licensing and resorting to market-determined prices as part of ERP from late 1984;

· Privatization of the SOEs, launched in 1988;

· Industrial policies to assist distressed but potentially viable SOEs in the early 1990s.

iii. Private sector-led accelerated industrial development strategy (since 2001): Industrial architecture based on value-added processing of Ghana's natural resource endowments through the private sector-led accelerated industrial development strategy.

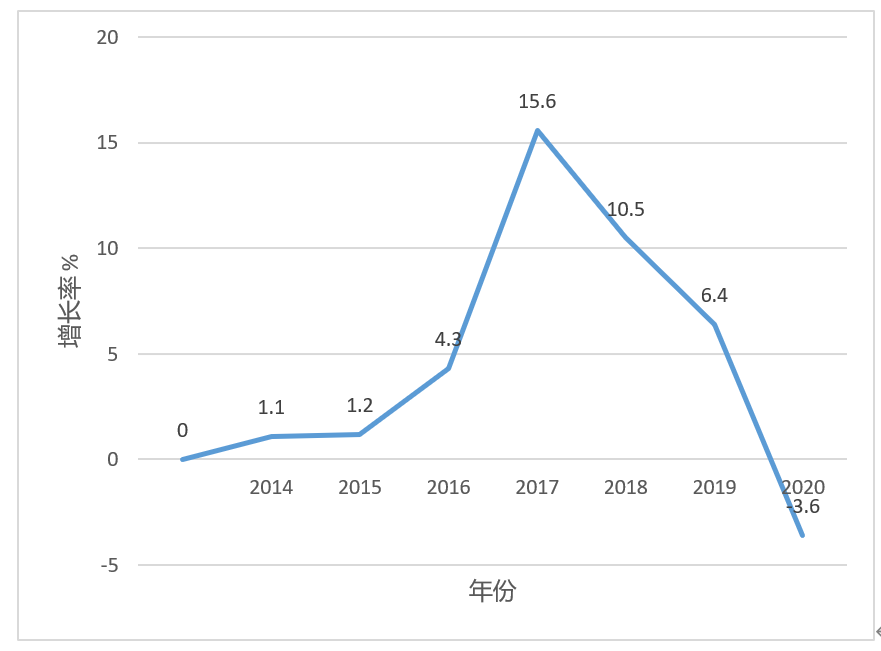

Prior to 2011, the sector's performance in terms of contributions to GDP was on the decline. Then in 2011, the country started the exploration and drilling in commercial quantities, and this increased the sector's growth in 2011 to 2013. After 2013, the sector experienced a decrease in its GDP contribution due to deterioration in the growth in the oil and gas subsector. The decrease is also attributed to the slow developments in the international market due to the decrease in oil prices coupled with the inability of the oil drilling and exploration companies in Ghana slowing down on production. The sector, however, recovered massively in 2017 due to the recovery of the oil subsector, which grew at about 15.6.

In 2017, the Ghanaian Government implemented a number of policies targetted at the industrial sector to boost its GDP. These policies with job creation among its focus are underpinned by the following:

i. pursuing aggressive industrialization and value-addition to agricultural produce

ii. providing tax and related incentives for manufacturing businesses in sectors such as agro-processing, light industries, pharmaceuticals, petrochemicals, garments and textiles, among others

iii. providing a reliable and cost-effective mix of energy supply for businesses

iv. providing the necessary incentives for private sector participation in health service delivery

v. pursuing policies that will reduce interest rates

vi. implementing policies that will reduce the cost of doing business

vii. stabilizing the currency

The country's industrial sector faces significant challenges, the principal ones of which are lack of access to finance, high interest rates, inadequate and poor quality raw materials for industrial processing, poorly developed domestic trade, weak consumer protection, lack of effective collaboration between research institutions and industry, poor trade facilitation, an unstable exchange rate, lack of coherent industrial development planning and initiatives, poor research and development support scheme for industry, lack of land for industrial zones, high import duties on raw materials, poor standards of certification, and an unreliable and expensive power source. With the economic downtown brought about by the Covid-19 pandenic together with the other challenges, the industry sectors GDP was negative -3.6 in 2020.

Figure 4 Performance of Ghana's Industrial Sector

Source: GSS, 2021

Industry Sub-sector contribution to GDP

After the rebasing of the national account estimates1 in November 2010, Ghana's industrial sector currently consists of oil sector, manufacturing, construction, mining and quarrying, electricity, and water, and sewerage. The rebasing of the Ghanaian Economy reflects the change in the total value of goods and services produced, growth rates, sectoral distributions, and other related indicators driven by GDP from 2006.

Ghana's petroleum sector has experienced significant growth, particularly since the discovery of oil in commercial quantities in the Jubilee fields in 2007. Average crude oil production capacity has been declining slightly over time, with an average of 176,000 barrels per day in September 2021.Some of the major oil and gas activities are conducted by international oil companies such as Tullow Ghana, Vitol, Kosmos Energy, ENI, and Aker Energy. Ghana's astronomically high GDP growth in 2011 was mainly the result of oil production. Additionally, at nearly a third of exports earnings, petroleum has indeed become a significant component of the Ghanaian Economy. Nevetheless, the growth in Ghana's oil GDP in recent times is negative with an oil growth of -13.4 for the first half of the year 2021. Among the factors contributing to this declined are

i. Lower international oil prices in recent years have caused slowdowns in petroleum industries across the globe

ii. Technical challenges in the Jubilee field over the years

iii. Maritime Border Dispute: Ghana versus Côte d'Ivoire

iv. Global economic crises due to Covid-19 pandemic

Ghana's manufacturing activities include the production of food, beverages, tobacco, textiles, petroleum refinery and cement, among others. From the industry specifics table, the manufacturing sector grew from -2.4 in 2014 to 9.5 in 2019. The increase in the manufacturing sector's GDP can be attributable to the governments one district,one factory policy (1D1F). The 1D1F initiative aiis ms to achieve this through a massive private sector-led nationwide industrialization drive, which will equip and empower communities to utilise their local resources in manufacturing products that are in high demand both locally and internationally. This will allow the country to reap the rewards of industrialization, increase agricultural and manufacturing output, reduce reliance on imports and increase food availability. Nevertherless, the global Covid-19 pandemic slowed the growth of the manufacturing sector

Construction deals with the major construction works, repairs, maintenance, alteration and demolition of buildings, highways, streets, bridges, roads, sewers, railways and communication systems. The growth in the construction subsector GDP , is largely because the income base of the Economy is growing and as such, demand for proper housing and road infrastructure is driving the growth in the sector. The housing sector boom is ongoing and that explains the subsectors continuous growth. Generally the sector's contribution to GDP peaked in 2012 when the oil exploration was at its apex. The construction sector's GDP has not been increasing partly due to unstability in inflation and consistent power outbreak. As of the third quarter of the year 2021, the construction sector's contribution was 8.2%.

The mining and quarrying subsector in Ghana covers the extraction of natural minerals in either solids, liquids, or gases and produces gold, diamonds, manganese, bauxite, salt, stones and sand. The mining sector plays a vital role in the Ghanaian Economy, as it attracts more than half of all foreign direct investment (FDI) and generates more than one-third of all export revenues. The mining industry is the largest tax-paying sector in the country and makes a significant contribution to gross domestic product (GDP) and employment. Despite the significant contribution of this sub-sector over the years, in the year 2020, the mining and quarrying sub-sector contribution to GDP was -15.2. The negative growth in Mining & Quarrying was largely due to a decline in petroleum output.

The activities of the public sector-dominated electricity and water and sewerage subsectors include the production and distribution of electricity and water and sewerage. The electricity, water, and sewerage subsectors were lumped together before rebasing. The electricity, water and sewerage subsector is largely charged with providing these utilities to the citizenry.

Ghana has made significant progress over the past 10 years in increasing electricity generation and access. This has supported higher levels of economic growth. However, beneath these improvements lies inefficiencies, including extraordinarily high distribution losses. Between 2000 and 2019, electricity generation capacity increased at a rate of 6.4% a year from 1,358 megawatts (MW) to 4,695 MW. Supply capacity has nearly doubled since the 2013 power crisis. At the same time, system peak demand grew at a 4.6% annual rate from 1,161 MW to 2,804 MW. The increase in power generation supported Ghana's Economy. Despite energy generation being more than demand, power remains expensive and unreliable and has become a constraint on doing business in the country. Despite most sectors decreasing their GDP in 2020, the electricity sector grew by 7.2%. The positive outturn was demand-driven, and are primarily due to Government interventions that reduced the price of electricity over the period to mitigate the economic impact of COVID-19 on citizens.

The drinking water supply and sanitation sector in Ghana, although significant with enormous contribution to the Ghanaian Economy, the sector faces a number of challenges, including very limited access to sanitation, intermittent supply, high water losses, low water pressure, and pollution. Nevertheless, the subsector recorded the highest average growth among the industries with a GDP ratio of 13.6 in 2020

Figure 5 Industry Subsectors

Source: GSS, 2021