--本文原刊载于环球网(Huanqiu.com)“西非漫谈”栏目

链接:https://opinion.huanqiu.com/article/49jLKUxyMAe

(作者:电子科技大学西非研究中心团队,执笔人:Ukwuoma Chiagoziem Chima(电子科技大学西非研究中心团队成员) 【西非漫谈】2022年第十四期,总第六十三期。译者:陈思雨(外国语学院);校对:赵韵涵(外国语学院);整理:黄锐(公共管理学院)、孟雅琪(公共管理学院);供稿:电子科技大学西非研究中心团队)

【西非漫谈】尼日利亚农业概览

Ukwuoma Chiagoziem Chima:Nigerian Agricultural Sector at A Glance

Background

Nigeria, a country in West Africa, is incredibly lucky to have fertile soil throughout the majority of its territory. Nigeria has 34 million hectares of arable land, of which 6.5 million hectares are used for perennial crops and 28.6 million hectares are used for meadows and pastures. Approximately 24% of Nigeria's GDP is derived from agriculture. Since then, agriculture has come to be seen as a crucial component of every nation's growth. Regarding its agriculture sector, Nigeria is a very fortunate nation.

Fishery

Livestock

Crop Production

Forestry

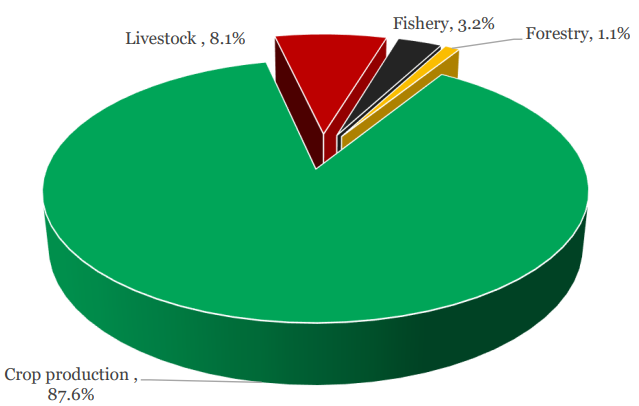

Figure 1. The Four Segment of the Nigerian Agricultural sector. Source: Google (Accessed: 21st July 2022)

Nigeria is a global leader in the production of a variety of agricultural products, including sorghum, cocoa, pineapple, and palm oil. Just after the United States, it is the second-largest sorghum producer in the world. In terms of palm oil and cocoa bean output, it is ranked fifth. Nigeria exports a lot of goods to other countries in this industry. One of the ten highest performing export categories is oil, followed by fruits, nuts, and seeds. The main crops grown in Nigeria's 70.8 million hectares of agricultural land are maize, cassava, guinea corn, yam beans, millet, and rice. The most frequent crop in the nation, maize, was grown by roughly 50% of agricultural families in Nigeria, according to a 2019 census. Followed by cassava crops with 46% of families cultivating this root. Guinea maize, yams, and beans were other common crops, being grown by 20% to 30% of the homes surveyed.

Nigeria Agricultural Sector

Nigeria's agriculture industry expanded by 3.16 percent (year over year) in real terms in the first quarter of 2022, down from the previous quarter's growth rate of 3.58% by 0.42% points. The sector contributed 22.36% to overall GDP in real terms in Q1 2022, higher than the contribution in the first quarter of 2021 and lower than the fourth quarter of 2021, which stood at 22.35% and 26.84%, respectively. The sector experienced nominal growth of 11.55% year over year in Q1 2022, a decline of 3.59% points from the same quarter of 2021 (National Bureau of Statistics (NBS) Q1 2022 GDP report). According to the research, Nigeria's Gross Domestic Product (GDP) increased by 3.11% (year over year) in real terms in the first quarter of 2022, marking the country's economy's sixth straight quarter of expansion.

As seen in Figure 1, Crop production, fisheries, livestock, and forestry comprise Nigeria's four main agricultural industries. Crop production still dominates the market, making for around 87.6% of the sector's overall output. Livestock, fishery, and forestry come in at 8.1%, 3.2%, and 1.1%, respectively. For more than seven years, agriculture has continued to be Nigeria's largest industry, contributing an average of 24% to the country's GDP (2013 – 2022). Additionally, the sector employs more than 36% of the labor force in the nation, making it the largest employer of labor in the nation.

Figure 2. According to the report, Nigeria's GDP increased by 3.11% (year over year) in real terms in the first quarter of 2022, marking the country's sixth consecutive quarter of positive growth. Source: Agro Nigeria https://von.gov.ng/nigerias-agricultural-sector-records-3-16-growth-q1-2022-nbs/

Key Highlights

According to NBS, the agriculture sector expanded by 3.16% (year-over-year) in real terms during the first quarter of 2022, up 0.88% points from the same time in 2021 and down 0.42% points from the previous quarter's growth rate of 3.58%. Quarterly, it increased by -28.10%.

v However, the sector's real-term contribution to total GDP in Q1202 was 22.36%, which was greater than its real-term contribution in the first quarter of 2021 and lower than its real-term contribution in the fourth quarter of 2021, which was 22.35% and 26.84%, respectively.

v In relative terms, the sector increased by 11.55% year over year in Q1 2022, down 3.59% points from the same quarter in 2021. There was a decline of 1.31% points as compared to the growth rate of 12.86% for the previous quarter.

v Crop Production continued to be the sector's key driver. This is clear since it accounted for 92.05% of the sector's total nominal growth in the first quarter of 2022. Growth from quarter to quarter in the first quarter of 2022 was -19.75%.

v In the first quarter of 2022, agriculture contributed 21.09% to the nominal GDP. This rate was lower than the first quarter of 2021's rate and lower than the fourth quarter of 2021's rate, which was respectively 21.42% and 24.17%.

v In the first quarter of 2022, Nigeria's Gross Domestic Product (GDP) increased by 3.11% (year over year) in real terms, marking the sixth quarter in a row that the economy has grown.

v The Nigerian economy's oil sector shrank by 26.04% (year over year) in the first quarter of 2022, a decline of 23.83% points from the pace seen in the comparable quarter of 2021.

v Nigeria produced 1.49 million barrels of oil per day on average in the first quarter of 2022, 0.23 million barrels per day less than in the same quarter of 2021 and 0.01 million barrels per day less than in the fourth quarter of 2021.

v The non-oil industry, on the other hand, expanded by 6.08% in real terms during the reference quarter (Q1 2022). This rate was 1.34% points higher than the fourth quarter of 2021 and 5.28% points higher than the rate seen in the same quarter of 2021.

Economic Impact

Fighting food hunger, encouraging diversity, and fostering economic growth all depend on the agriculture industry. Despite showing some indications of recovery in the last quarter of 2020, the epidemic caused a recession in Nigeria's economy. The industry increased by 3.4% year-over-year in the fourth quarter of 2020, up from 1.4% in the previous quarter, before slowing to 2.3% in the first three months of 2021, according to the National Bureau of Statistics (NBS). 2020 saw full-year growth of 2.2%, which was somewhat less than the 2.4% recorded in 2019. In terms of GDP contribution, industry and services made up 18.8% and 54.3%, respectively, while the sector made up 27% in the fourth quarter of 2020. The sector contributed 24.5% of GDP annually. In general, agriculture continued to be one of the economy's most robust sectors in 2020 when it came to external shocks. The World Bank estimates that in 2019, the industry employed around 35% of all workers, making it the largest employer in the nation.

Figure 3. Illustration of the Size of the different Agricultural sector of Nigeria. Source: NBS, PwC analysis, AfCFTA WORKSHOP

Oversight & Policy

With a mandate to "ensure food security in the crop, livestock, and fisheries; stimulate agricultural employment and services; promote the production and supply of raw materials to agro-industries; provide markets for the industrial sector's products; generate foreign exchange and rural socio-economic development," the sector is governed by the Federal Ministry of Agriculture and Rural Development (FMARD). FMARD has its own technical and service departments, which include those in charge of, among other things, agriculture, fisheries, livestock, fertilizers, food reserve and storage, finance, procurement, planning, and cooperatives. FMARD also supervises about 50 parastatals that operate as departments or agencies. The Agriculture Promotion Policy commonly referred to as the Green Alternative, is the most significant component of agricultural policy. The goal of the policy, which is based on the successes of the sector-strengthening Agricultural Transformation Agenda, is to ensure that there is enough output to fulfill local demand and export quality rules while also putting the agriculture sector on a growth path.

v The Economic Recovery and Growth Plan (ERGP) 2017–20 was introduced by the federal government in the wake of the 2016 recession to revive economic growth by broadening the nation's economic base and generating jobs. In terms of agriculture, the plan calls for modernizing the industry and ensuring food security to develop Nigeria into an industrialized economy with a special emphasis on agro-processing and the production of food and beverages.

v The CBN's Anchor Borrowers' Programme (development finance institution), which was introduced in 2015, aims to connect smallholder farmers with agro-processors by providing money and inputs.

v The Nigeria Sovereign Investment Authority (NSIA) introduced the Presidential Fertilizer Initiative (PFI) in 2017, which aims to increase farmers' access to fertilizers and enhance crop performance. Since its beginning four years ago, the PFI has produced over 30 million 50-kg bags of fertilizer and saved over $350 million in subsidy and import substitution payments. The federal government gave its approval in April 2021 for the PFI to be restructured for a further four years.

Challenges of The Agricultural Sector

Despite its economic impact, Nigeria's agriculture industry suffers several obstacles that lower production. Poor land tenure systems, insufficient irrigation for agriculture, climate change, and land degradation are a few of them.

v Nigeria's road and rail infrastructure and services are extremely lacking, especially in rural regions, which limits access to markets and increases post-harvest losses. Losses from spoiling and impact time to market caused by a lack of cold chain capabilities also lower trade capacity.

v The infrastructure supporting ICT and e-commerce is essential to the accessibility of market information and the speed of responses. Despite recent advances in digital and telecommunications technology, Nigeria's ICT infrastructure still has to be significantly improved to facilitate effective trading.

v The six seaports in Nigeria are constrained by a lack of space and deteriorating infrastructure. Additionally, the systems for border and customs administration are often ineffective and have several bottlenecks. These have a detrimental effect on cross-border trade's price, simplicity, and effectiveness.

Meanwhile, intermittent flooding, Boko Haram insurgencies, and disputes between herders and local farmers have all negatively impacted Nigeria's agricultural industry. Infrastructure and funding issues in food processing are still present. In Q1, 2021, food inflation increased to 22.95%. Numerous products saw price rises, including cereals, yams, pork, fish, and fruits. Food inflation has several root causes, including escalating farmer-herder conflict, banditry, abduction, and insurgency in Nigeria's agricultural belt that the Nigerian government is battling to quell. The native currency, the naira, has had repeated devaluations in 2021, which adds to the increasing pressure. Moreover, increased gasoline costs have led to an increase in food prices.

The Fight against Diminishing Agricultural Productivity

The country's agricultural productivity is dropping, which has an impact on the sector's GDP contribution as well as higher food imports as a result of population growth and declining levels of food sufficiency. For instance, Nigeria's total agricultural imports from 2016 to 2019 were N3.35 trillion, which is four times the country's total agricultural export of N803 billion over the same period.

Nigeria's food and agricultural output deficits are filled by $10 billion in imports (mostly wheat, rice, poultry, fish, food services, and consumer-oriented foods). The principal exporters of agricultural products are Europe, Asia, the United States, South America, and South Africa.

To diversify its economy away from oil, the Government of Nigeria (GON) has launched agricultural projects including the Anchor Borrowers Program (ABP). A new agricultural strategy called the "National Agricultural Technology and Innovation Plan" was authorized for execution by GON at the Council on Agriculture and Rural Development Regular Meeting (NATIP). The four-year plan is intended to aid in the COVID-19 economic recovery of Nigeria. The Agriculture Promotion Policy (APP), which was introduced in 2016 and was set to expire in December 2020, will be replaced by this policy.

As part of its response, the government has also put in place several initiatives and programs, such as the Agriculture Promotion Policy (APP), Nigeria-Africa Trade and Investment Promotion Programme, Presidential Economic Diversification Initiative, Economic and Export Promotion Incentives, and the Zero Reject Initiative, as well as the Nigeria Erosion and Watershed Management Project (NEWMAP), Action Against Desertification, and Reducing Emission from Deforestation and Forest Degradation (REDD+).

All of these initiatives are made to boost agricultural production to produce both an abundance of commodity crops for sale on the global market and enough food to fulfill domestic demand. In addition, they seek to reverse forest loss and degradation, support sustainable resource management, restore degraded lands, and lessen erosion and climate vulnerability.

Agricultural Import and Export in Nigeria

Nigeria's agricultural imports have increased significantly while exports have decreased as a result of the decreased production. For instance, from $653 million in 2019 to around $489 in 2020, U.S. food and agricultural exports decreased by nearly 33%. Over the previous five years, American exports of food and agricultural goods to Nigeria totaled $537 million on average, with wheat accounting for nearly 70% of those shipments. Nigeria was the fifth-largest importer of U.S. wheat in the world in 2020 with approximately 1.29 million metric tons imported. Nigeria also imports soybeans from the United States, intermediate food items (particularly vegetable and animal fats), consumer-focused food items (such as condiments and sauces, processed vegetables, wine, prepared foods, dairy products, and non-alcoholic ethanol), and fish goods.

However, in 2019, imports of food and agricultural products from Nigeria totaled $50 million (down just 2% compared to 2018). The top imports of food and agricultural goods from Nigeria to the United States include cocoa beans, tea and herbal items, feeds and fodders, cashew/tree nuts, spices, and seafood.

A significant producer of rice and cassava in Nigeria. Nigeria produced 4.0 million metric tons of rice in 2018, up from 3.7 million in 2017. Despite this, only 57% of the 6.7 million metric tons of rice that Nigeria consumes each year is produced locally, leaving a shortage of around 3 million metric tons that must either be imported or smuggled into the nation. To boost domestic production, the government prohibited rice imports in 2019. Nigeria was the world's greatest producer of cassava in 2017, producing over 59 million tons (approximately 20% of global production). With strong revenue returns from domestic value addition and derived income as well as revenues for the government, the economic potential is considerable. Manufacturing is predicted to rise with improved cultivars and production methods. The African Growth and Opportunity Act favors Nigeria, although the country has had difficulty maximizing the advantages of the trade preferences. The nation's sanitary and phytosanitary (SPS)/food safety system is poor, making it difficult for food exports to adhere to international norms.

REFERENCES

[1] Nigeria Agriculture Sector – International Trade Administration Published 13th October 2021. https://www.trade.gov/country-commercial-guides/nigeria-agriculture-sector.

[2] Taiwo Oyaniran, Associate Director, PwC Nigeria, AfCFTA WORKSHOP, Current State of Nigeria. Agriculture and Agribusiness Sector https://www.pwc.com

[3] Agriculture in Nigeria: Statistics and facts. Doris Dokua Sasu, Apr 5, 2022, https://www.statista.com/topics/6729/agriculture-in-nigeria

[4] The future of livestock in Nigeria

[5] William Ukpe May 23, 2022, in Agriculture, GDP, Macro-Economic News https://nairametrics.com/2022/05/23/gdp-nigerias-agriculture-sector-records-growth-of-3-16-in-q1-2022/

[6] Oxford Business Group. https://oxfordbusinessgroup.com/overview/farm-table-plans-revitalise-industry-are-centred-increasing-local-production-and-improving-value

[7] https://www.nationsencyclopedia.com/economies/Africa/Nigeria-AGRICULTURE.html

[8] https://www.pwc.com/ng/en/assets/pdf/afcfta-agribusiness-current-state-nigeria-agriculture-sector.pdf

[9] https://www.iita.org/cropsnew/cassava/

[10] https://www.pwc.com/ng/en/assets/pdf/cassava-production-nigeria-report-2020.pdf

[11] Payne I. The changing role of fisheries in development policy. Natural Resource Perspectives, ODI/DFID. 2000

[12] Agro Nigeria. https://von.gov.ng/nigerias-agricultural-sector-records-3-16-growth-q1-2022-nbs/