Koffi Dumor:The sustainability of cocoa farming in Ghana and Côte d’Ivoire

I. Introduction

The European Union is the world's biggest cocoa importer, accounting for 60% of global imports. Côte d'Ivoire, Ghana, and Cameroon are the largest cocoa exporters to the EU market, contributing €4.6 billion annually (2021). As per their separate Economic Partnership Agreements, they enjoy duty-free and quota-free access.

Numerous cocoa growers already live at or below the poverty level and need a higher price for a more sustainable crop. The Commission began its Sustainable Cocoa Initiative in September 2020 to improve cocoa production and commerce sustainability. In 2021, the EU conducted eight virtual roundtables, the Cocoa Talks, which brought together EU cocoa industry stakeholders and representatives from Ghana, Côte d'Ivoire, and Cameroon. Ghana and Côte d'Ivoire also initiated parallel national talks, while Cameroon did the same. Parallel to this, cocoa sustainability talks continue within the context of Economic Partnership Agreements.

Although supply chain issues in the cocoa industry are not new, this project responds to the increasing demands of EU consumers and the EU's strong political will to make supply networks more sustainable. It builds on President von der Leyen's "zero-tolerance approach to child labor." It contributes to the ongoing work on EU legislation on corporate sustainability due diligence along EU supply chains and on addressing global deforestation and forest degradation related to the EU's consumption footprint.

In Côte d'Ivoire, the European Union and the European Investment Bank intend to provide about €200 million to Côte d'Ivoire. In 2021, the national Multi-Annual Indicative program 2021-2027 for Côte d'Ivoire will provide €18 million to assist in the execution of the "Sustainable Cocoa" project under the Global Gateway. Further action is anticipated in 2022 and 2023.

In Ghana, up to 2023, the EU will provide at least €12 million to the cocoa industry, including via a program to assist green transformation, agriculture, and cocoa that is already scheduled for 2023. Cocoa will also be handled as a value chain under the "Climate-smart agriculture, agribusiness, and natural resources management" component of the Team Europe Initiative under "Smart, green, and digital recovery" of the Global Gateway. In addition, a systematic policy discourse on cocoa production reform and its execution would be emphasized.

https://www.confectionerynews.com

1. Country Comparison

This country comparison is a concise, tabular overview of numerous data from our respective Ivory Coast and Ghana. For further information and explanations, we provide many details per country that go far beyond this comparison (including General information, population, and economy).

General information

|

Ivory Coast |

Ghana |

Region: |

Western Africa |

Western Africa |

Area: |

322,460 km² |

238,540 km² |

Official language: |

French |

English |

Government form: |

Presidential republic |

Presidential republic |

Independent since: |

1960 AD |

1957 AD |

Capital: |

Yamoussoukro |

Accra |

Population

Details for Ivory Coast and Ghana

Currency: |

Ivory Coast (West African franc) |

Ghana cedi (1 GHS =100 Pesewas) |

Unemployment rate: |

3.50% |

4.70% |

Inflation rate: |

4.09% |

9.97% |

Cost of Living:(USA = 100%) |

42.67% |

37.33% |

Commercial taxes and contributions: |

50.10% |

55.40% |

Average income: |

2,450 US$ |

2,360 US$ |

Corruption index: |

64 (bad) |

57 (bad) |

Economy

Details for Ivory Coast and Ghana

Currency: |

Ivory coast (West African franc) |

Ghana cedi (1 GHS =100 Pesewas) |

Unemployment rate: |

3.50% |

4.70% |

Inflation rate: |

4.09% |

9.97% |

Cost of Living(USA = 100%): |

42.67% |

37.33% |

Commercial taxes and contributions: |

50.10% |

55.40% |

Average income: |

2,450 US$ |

2,360 US$ |

Corruption index: |

64 (bad) |

57 (bad) |

|

CIV: total |

per 1000 inh. |

GHA: total |

per 1000 inh. |

Gross domestic product: |

69,765 M US$ |

2.58 M US$ |

77,594 M US$ |

2.45 M US$ |

Gross national product: |

66,354 M US$ |

2.45 M US$ |

74,911 M US$ |

2.36 M US$ |

Exported goods: |

13,232 M US$ |

0.49 M US$ |

22,077 M US$ |

0.70 M US$ |

Imported goods: |

12,660 M US$ |

0.47 M US$ |

24,545 M US$ |

0.77 US$ |

1.1 Ghana and Côte d’Ivoire boycott chocolate industry meetings

Ghana and Côte d'Ivoire are skipping the World Cocoa Foundation partnership meetings in Brussels, Belgium, to protest against the current cocoa trade market conditions.

In addition, the Côte d'Ivoire-Ghana Cocoa Initiative (CIGCI) Secretariat will not be attending the conference that begins today.

The complaints of the two nations pertain to the underlying antagonism to the Living Income Differential (LID).

Alex Assanvo, Executive Secretary of the CIGCI, states, "Our members are unhappy with the current situation, and we want to send a clear message that we will not jeopardize farmers' livelihoods."

The LID was enacted in 2019 to provide cocoa farmers with a minimum price to increase their income since many cocoa growers live in poverty.

The LID is $400 per ton of cocoa and is taxed in addition to global pricing.

However, the LID has been undercut by commodities traders who have imposed negative Country Differentials (CD) of -$260 per ton on the London and New York Cocoa Futures for Ghana and Ivory Coast.

Le Conseil du Café Cacao (CCC) and the Ghana Cocoa Board (COCOBOD) have complained about the state of affairs.

In an effort to increase openness, Ghana and Côte d'Ivoire have begun posting origin differentials, and on July 1, 2022, it was decided that neither nation will export cocoa with negative country differentials.

Simultaneously, the industry initiated a procedure to pave the way for an economic treaty all the foremost corporations signed.1.2 Observers from Ghana and Côte d'Ivoire have supported the boycott

The Ivorian Platform for Sustainable Cocoa and the Ghana Civil-society Cocoa Platform are comprised of farmers, farmer-based groups, cocoa cooperatives, small-scale processors, media, and civil society organizations engaged in the cocoa industry, praising the action.

"We believe the time has come for the international community to recognize the double standards of the multinational cocoa and chocolate industries, particularly with regard to cocoa pricing and the deteriorating living conditions of cocoa farmers as a result of their self-seeking interests and desire to maximize profits without a willingness to distribute profits along the value chain."

1.3 Pricing as key to cocoa sustainability

Ghana and Côte d'Ivoire produce over two-thirds of the world's cocoa supply. However, the vast majority of cocoa growers in these nations live far below the poverty line. Poverty among farmers is a significant factor in exploitation in the cocoa industry, including forced labor and child labor.

Obed Owusu-Addai from Eco Care Ghana tells VOA:

How can it be that in an industry of about $130 billion, the farmer only receives only 6% of the profit? We think it is unfair, and it’s about time we began discussing pricing as the most critical issue regarding cocoa sustainability.

https://www.cnbc.com/2021/11/02/volatile-cocoa-prices-are-pushing-african-farmers-further-into-poverty.html

i. World Cocoa Foundation pledges to maintain dialogue with Cote d’Ivoire and Ghana after Partnership Meeting snub

The World Cocoa Foundation (WCF) concluded a successful Partnership Meeting, despite the absence of the two major producing nations, by announcing new pledges to improve the sustainability of cocoa supply chains and increase the effectiveness of its efforts to assist farmers in earning a livable wage.

1 Top 10 cocoa producers in the world

The major cocoa-producing countries are:

- West Africa (Ghana, Nigeria & Cote D’Ivoire) – known for growing some of the world’s best quality cocoa

- South America (Brazil & Ecuador)

- Asia (Malaysia & Indonesia) – cocoa is a relatively new crop here but is increasingly becoming an essential growing area

https://www.kakaoplattform.ch/about-cocoa/cocoa-facts-and-figures

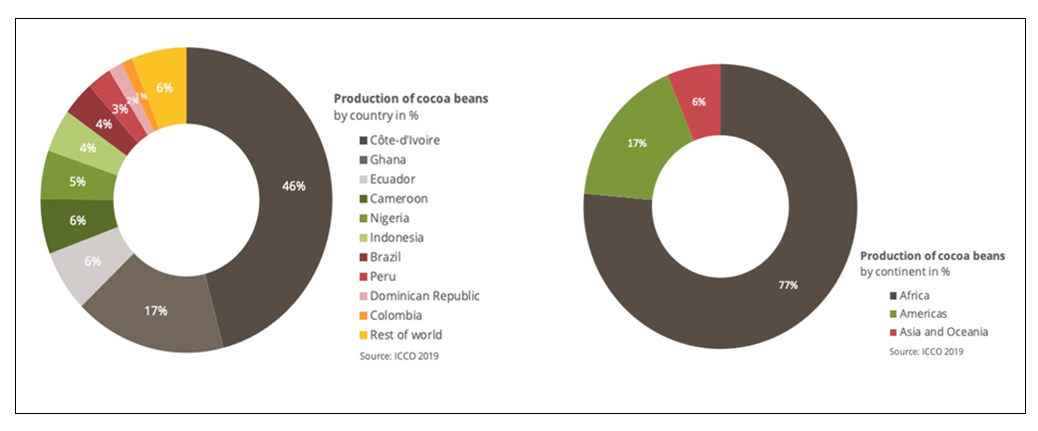

The Pie Graph above gives a different visual representation of the top 10 cocoa-producing countries in 2019. Graph#2 shows how Cote d'Ivoire was responsible for 33% of the world’s cocoa production in 2019, while Ghana was the second highest at 17%. Ecuador, Cameroon, Nigeria, Indonesia, Brazil, Peru, Dominican Republic, Columbia, and the rest of the World were the countries producing the least amount of the world’s cocoa, with only 1-2%.

2.2 Most cocoa is produced in West Africa

In the 2018/2019 cocoa season, a total of 4.8 million tons of cocoa was produced worldwide. Côte d'Ivoire and Ghana are the two largest cocoa producers, accounting for over 60% of global cocoa production, followed by Ecuador with seven percent. Indonesia is the biggest cocoa producer in Asia.

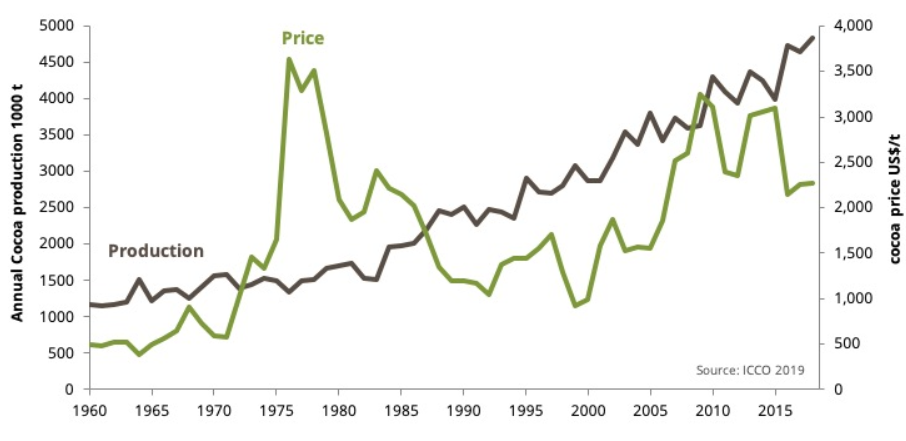

Cocoa production has been continuously increasing over the past 40 years. Up to 95% of cocoa beans are traded on global commodity markets. The cocoa market is prone to trends and fluctuations between chaotic booms and busts triggered by political instabilities, weather-related production deficits, and overproduction.

https://www.kakaoplattform.ch/about-cocoa/cocoa-facts-and-figures

During the 2016/2017 cocoa season, a record-breaking crop prompted prices to collapse to levels not seen in 10 years. Since this price low, however, prices have begun to rebound.

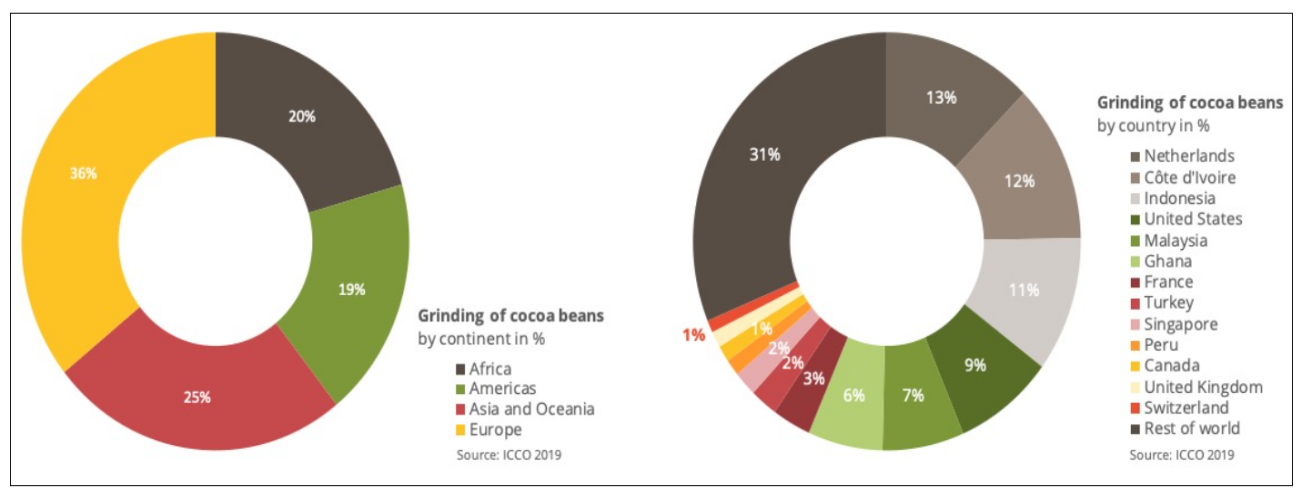

3.Europe is the leading processor of cocoa beans

Cocoa beans are processed into cocoa mass, butter, cocoa powder, chocolate, and other cocoa products worldwide. Europe grinds around 40% of the yearly harvest. 13% of the beans, or 600,000 tons, are crushed in the Netherlands alone. Switzerland carries out around 46,000 tons of cocoa, corresponding to only 1% of global cocoa production.

https://www.kakaoplattform.ch/about-cocoa/cocoa-facts-and-figures

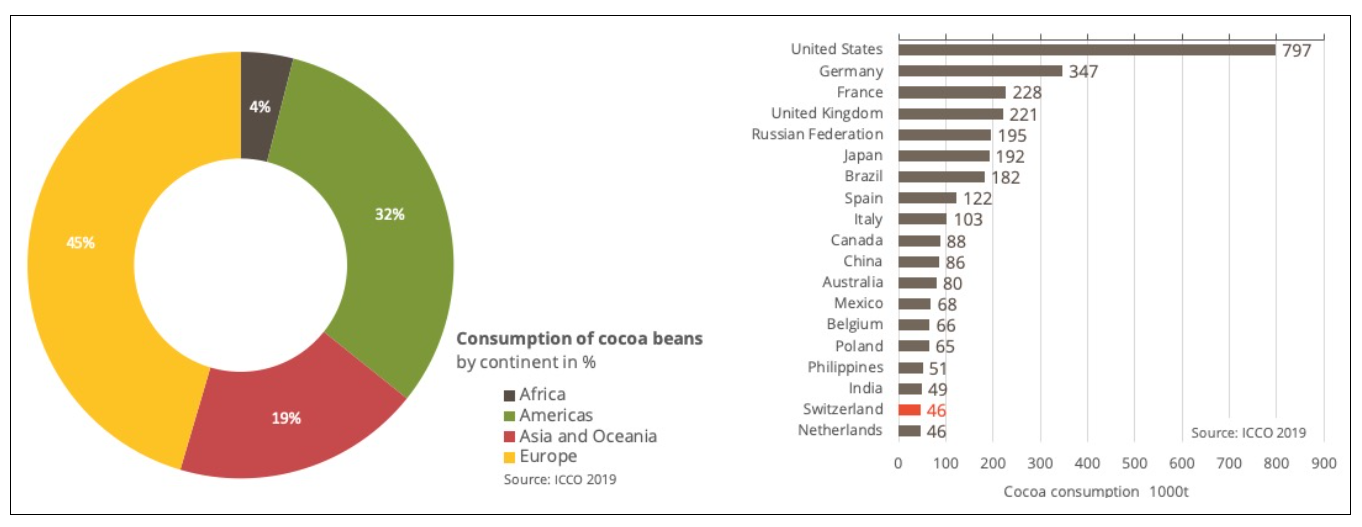

3.1 The Europeans are the champions in cocoa consumption

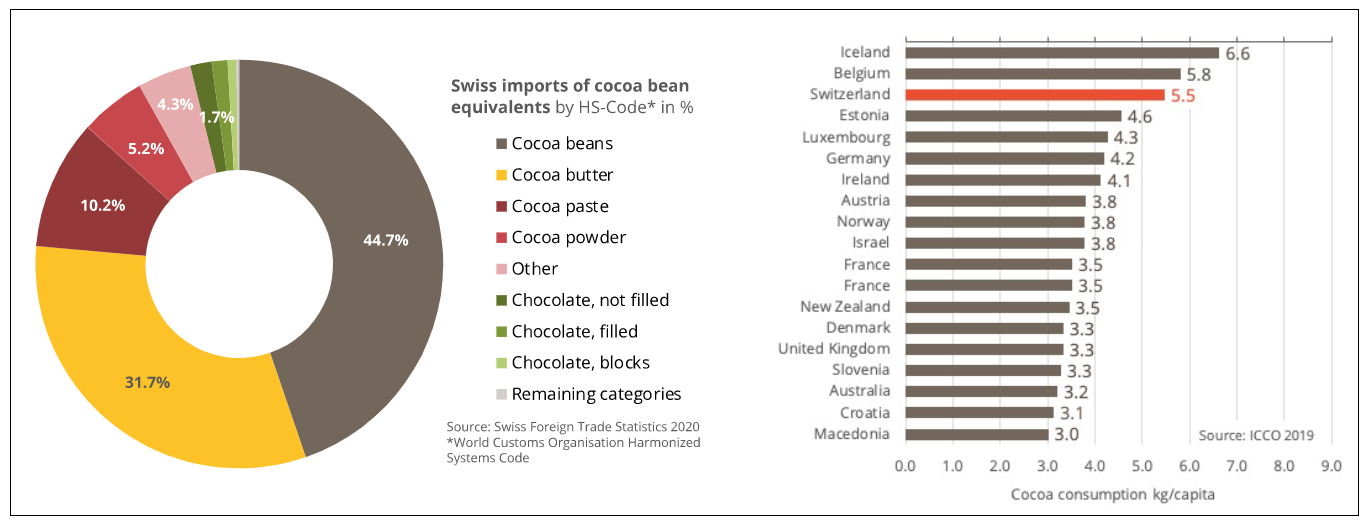

Europe is responsible for 45 percent of the world's cocoa consumption, followed by the Americas. The United States consumes more cocoa-based goods (797 million tons) than Germany and France combined. With an annual consumption of little more than 46 thousand tons, Switzerland ranks eighteenth in the world. With 5.5 kg cocoa bean equivalents per person, Switzerland is second only to consumers in Iceland and Belgium in terms of per capita consumption.

https://www.kakaoplattform.ch/about-cocoa/cocoa-facts-and-figures

Switzerland imports the majority of cocoa equivalents in the form of cocoa beans, cocoa butter, and cocoa paste. A negligible amount of cocoa bean equivalents is imported as semi-finished and finished cocoa goods.

https://www.kakaoplattform.ch/about-cocoa/cocoa-facts-and-figures

3.2Concluding remarks

The sustainability of cocoa relies on the harmony of three factors: production and trade efficiency (for all players), social protection, and environmental preservation. Reform of national, regional, and international legal and policy instruments is urgently required to enable this reconciliation. In Ghana and Côte d'Ivoire, the production and trade of cocoa are organized and regulated by national legal and institutional frameworks. These nations also host several international or regional programs to enhance the cocoa industry's sustainability. However, these programs and regulatory frameworks are uneven and insufficient with regard to the aforementioned three sustainability aspects, and their gaps and weaknesses contribute to the previous challenges.

Several projects have also been undertaken in consumer nations to address sustainability challenges in the cocoa industry. The European Union and the United Kingdom have acknowledged the environmental impact of commodities such as cocoa and have enacted regulations to reduce the use of commodities connected to deforestation or forest degradation in their respective markets. Other pieces of pending EU legislation, such as the Corporate Sustainability Due Diligence Directive, which aims to minimize adverse human rights and environmental impacts in companies' value chains, the review of the Environmental Crime Directive, and the legislative consolidation of certification mechanisms, may also encourage change in the cocoa sector.

Reference:

https://www.nitidae.org/files/766babc9/sustainability_initiatives_in_ivorian_and_ghanaian_cocoa_supply_chains_benchmarking_and_analysis.pdf

https://www.clientearth.org/media/2a3lozcz/a-legal-pathway-to-sustainable-cocoa-in-ghana-and-c%C3%B4te-d-ivoire-introduction.pdf

https://international-partnerships.ec.europa.eu/news-and-events/news/eu-cote-divoire-ghana-and-cocoa-sector-endorse-alliance-sustainable-cocoa-2022-06-28_en

https://citinewsroom.com/2022/10/ghana-cote-divoire-boycott-world-cocoa-foundation-meeting/

https://www.worlddata.info/country-comparison.php?country1=CIV&country2=GHA

https://www.confectionerynews.com/Article/2022/10/31/World-Cocoa-Foundation-pledges-to-maintain-dialogue-with-Cote-d-Ivoire-and-Ghana-after-Partnership-Meeting-snub

https://www.freedomunited.org/news/ghana-cote-divoire-boycott/

https://www.kakaoplattform.ch/about-cocoa/cocoa-facts-and-figures