--本文原刊载于环球网(Huanqiu.com)“西非漫谈”栏目

链接:https://m.huanqiu.com/article/4BL21wOzLHA

【西非漫谈】2023年第1期,总第68期。作者:电子科技大学西非研究中心团队;执笔人:Koffi Dumor(电子科技大学西非研究中心团队成员);译者:赵韵涵(外国语学院);校对:陈思雨(外国语学院);整理:孟雅琪(公共管理学院);供稿:电子科技大学西非研究中心团队)。

Koffi Dumor:Investing in long-term change in Guinea through mining

Guinea's economy is based on the mining sector (26 per cent of GDP, including processing bauxite into alumina) and agriculture (20 per cent), the former providing 95 per cent of export earnings, and the latter the remainder. Exports' share of GDP rose from 34 per cent in 2005 to 41 per cent in 2009, highlighting the strong global demand for bauxite, diamonds and gold, and the weakness of the other sectors in Guinea's economy. In 2011, substantial foreign direct investment (FDI) in the production of alumina and iron ore was planned, together with two port extensions. This investment is for an amount comparable to the country's annual GDP. It is therefore vital to introduce appropriate macroeconomic policies, including trade policies, so as to prevent the strong inflationary trends which such investment might cause.

Alcircle.com

Guinea's economy grows 7% in 2020 amid dual pandemic, bauxite mining plays a vital role; Bauxite Mining, Price, Ore, Mineral, and Formula, Production.

The growth figure reported is even well above the 5.2% previously forecasted by IMF. Clara Mira led IMF virtual mission said “the good performance was mainly driven by the mining sector.”

Guinea’s mining sector recorded a rise of 18.4% in mining activity in 2020, against only 8% in 2019, as data supplied by African Development Bank (AfDB). Bauxite, the raw material of aluminum is accredited for its high demand, of which the nation has become the main supplier since 2017.

Even though 2020 revealed better results than expected, 2021 shows signs to take the opposite path. This slowdown might be due in particular to the impact of the health crisis on the country’s non-mining economy.

Clara Mira said: “Despite the implementation of a swift and well-structured response plan, the pandemic took a significant toll on the non-mining economy, which accounts for over ¾ of total GDP and employs the vast majority of the population.”

Overview

The mining industry has the most potential. Bauxite, iron ore, gold, and diamond mining are significant markets for Guinea, and tens of international businesses are actively producing and exporting minerals. Guinea also has economically feasible amounts of graphite, manganese, nickel, and uranium. However, they have not yet been utilized commercially. In 2020, Guinea exported slightly over USD 3.3 billion worth of bauxite (82,4 million tons at $50/ton) and USD 1.2 billion worth of gold (434 oz at USD 1,392/oz). The logistical complexity of transporting ore to ports prevents the exploitation of vast quantities of high-quality iron ore. The two new iron ore mines at Simandou and Mount Nimba are expected to begin exporting within the next five years after the mining sites and related rail links are finished. To export iron ore from the Simandou project, a rail link to the Liberian port of Buchanan is proposed, while Nimba's deposits will be sent through a rail connection to the Liberian port of Buchanan.

|

Operational Projects |

Projects Under Development |

Bauxite |

9 |

11 |

Gold |

2 |

10 |

Iron |

1 |

4 |

Graphite |

0 |

1 |

Diamond |

3 |

3 |

Alumina |

1 |

7 |

Limestone |

0 |

0 |

Total |

16 |

36 |

https://www.stat-guinee.org/

(total market size = (total local production + imports) - exports)

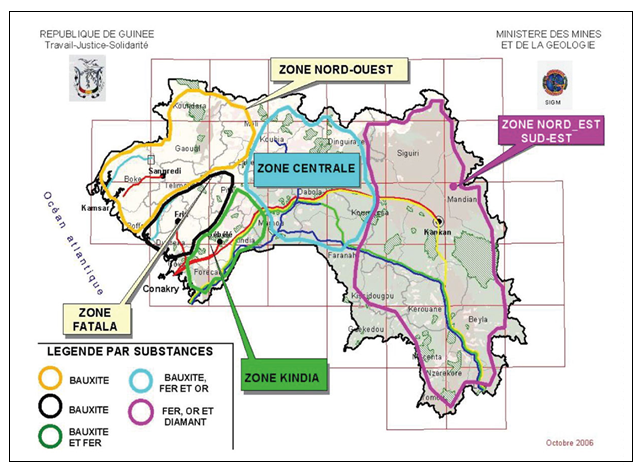

Figure1: Location of main minerals

Notes: Maps from- the Ministry of Mines and Geology, Republic of Guinea

Sectors

Bauxite mining is a growth industry, with new companies opening concessions and expanding existing operations. Additionally - and linked to the success of mining developments - road and railroad construction is a potentially lucrative market in the future. However, most recent large road construction contracts went exclusively to politically well-connected Guinean or Chinese construction firms. Guinea holds 35 percent of the world’s bauxite reserves (10-40 billion tons) and has become the second leading bauxite exporter after Australia since 2019, according to the October 2020 World Bank Group report on Commodity Markets Outlook.

Bauxite |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

Total Local Production (thousand metric tons) |

17,700 |

31,500 |

45,000 |

50,000 |

66,279 |

82,404 |

Total Exports (USD millions) |

596.96 |

882.99 |

1888.40 |

2.010.00 |

3.313.97 |

4127.91 |

Exports to the U.S. (USD millions) |

74.22 |

2.55 |

0 |

0 |

0* |

0 |

Total Imports (USD millions) |

0 |

0 |

0 |

0 |

0 |

0 |

Average price of bauxite imported to U.S. (USD per metric ton) |

28 |

28 |

N/A |

N/A |

N/A |

N/A |

https://www.stat-guinee.org/

(total market size = (total local production + imports) - exports)

Opportunities

There are opportunities for exporting machinery and equipment to Guinea, particularly in the mining sector. Several mining companies are in their contracts' early exploration or construction phases and will likely look to make substantial investments in machinery and construction equipment in the upcoming years. New hotels, office buildings, and road construction in and around Conakry also offer machinery and equipment sales opportunities.

The development of Guinea's vast mineral reserves is accelerated by China's drive to increase alumina production.

With China’s own bauxite supply declining in quality and resource nationalism in countries such as Indonesia and Malaysia preventing more apparent sources, the matter became vital for China – and an opportunity for Guinea. This case study, which concluded in 2019, describes how CRU helped a junior mining company demonstrate the commercial feasibility of its Guinean bauxite project to investors.

The development of Guinea's vast mineral reserves is accelerated by China's drive to increase alumina production.

With China’s own bauxite supply declining in quality and resource nationalism in countries such as Indonesia and Malaysia preventing more apparent sources, the matter became vital for China – and an opportunity for Guinea. This case study, which concluded in 2019, describes how CRU helped a junior mining company demonstrate the commercial feasibility of its Guinean bauxite project to investors.

CRU’s work underpins the financing of many of the largest and most high-profile African mineral projects. We are trusted by investors to deliver the most authoritative independent assessment of a project’s commercial prospects.

Low freight rates offset Australia’s proximity advantage

Imported bauxite demand is expected to grow strongly due to increased Chinese requirements and, in the longer term, because of declining domestic ore reserves and ore quality. Meanwhile, exports from Indonesia have been disrupted by a push to convert bauxite to alumina locally, while Malaysian supply has been restricted by environmental issues.

This would evidently present an opportunity for investors in new bauxite projects in locations such as Guinea. Asian and Australian miners enjoy low shipping distances to China, but low freight rates and high-quality bauxite enabled Guinea to overtake Australia as the largest supplier in 2017. Although freight rates were expected to increase, those producers in Guinea able to ship using Capesize vessels can offset the proximity advantage enjoyed by Australian miners who are generally restricted to Panamax vessels.

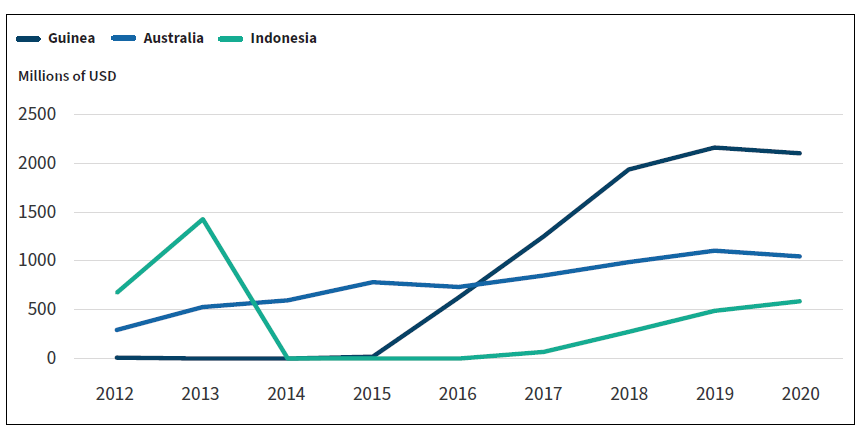

Figure 2: China has experience a large shift of bauxite import sourcing.

CRU database

China’s main interest has been to secure bauxite supply in a bid to meet its requirement for increasing alumina production as well as to keep prices down via competitive pressure. Several of the bauxite projects being built by Chinese companies in Guinea are to serve captive refineries rather than third-party demand: for example, Weiqiao’s two projects of 17M tonnes per year (from 2020) will meet demand from its low-temperature refineries in Shandong. It is critical for investors in new bauxite projects in Guinea and elsewhere to understand the contestable (third-party) market size in order to determine how a project will be able to place its product going forwards.

China's Aluminum Ore Imports

Guinea became China's primary source of bauxite in 2017

Data from “Aluminum Ore in China,” Observatory of Economic Complexity, accessed May 2022

The timing of SMB engagement Winning in Guinea's bauxite and iron ore industries was impacted by fluctuations in worldwide mineral markets and China's trading links. China is the world's biggest aluminum producer; thus, guaranteeing access to bauxite coincides with Beijing's macroeconomic aims and the financial interests of China's many aluminum enterprises. SMB-Winning is one of the key participants in the business, alongside the Anglo-Australian-Guinean Compagnie des Bauxites de Guinée (CBG) and Russia's RUSAL. Several Chinese state-owned metals firms are also active in the development of Guinea's bauxite sector.

The beginning of SMB-bauxite Winning's activities in Guinea coincided with the 2014 restriction on bauxite exports by the Indonesian government. Guinea has already surpassed Indonesia as China's leading bauxite supplier, delivering over fifty percent of imports even after Indonesia relaxed its embargo on bauxite in 2017. 9 Now, as Indonesia prepares to restrict exports again in 2023, industry executives in China are optimistic that Guinea can make up for the inevitable shortage. After China successfully gained access to bauxite supplies, subsequent efforts by Chinese companies to access iron ore from Guinea's Simandou mine aligned with Beijing's desire to diversify iron ore supplies, remarkably to reduce iron ore reliance on Australia in the context of deteriorating bilateral relations.

A coalition of international corporations may not appear like a plausible candidate for incorporation into the CCP Inc. ecosystem at first look. However, a deeper examination of SMB-ownership Winning's structure, affiliations to the CCP, and business history reveal that the company's core is connected to Chinese state actors and the CCP. In addition, the consortium's numerous relationships with SOEs demonstrate how access to the networks of Chinese state-owned companies helped it to fulfill its economic objectives by linking mines to trains, highways, and international ports.

Resources

· Guinean Ministry of Mines

· Guinea Ministry of Mines - Mining Cadastre

· 2013 Mining Code

· Guinean Ministry of Investment and Public-Private Partnerships

· Guinean Employment Promotion Agency (AGUIPE)

· Natural Resources Governance Initiative - Guinea

· Petroleum and Mining Contracts - Guinea

· Extractive Industries Transparency Initiative - Guinea

Reference:

https://www.csis.org/analysis/ccp-inc-west-africa

Guineahttps://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/mining-for-long-term-change-in-guinea

https://www.csis.org/programs/freeman-chair-china-studies/ccp-inc

Abegunrin, O., & Manyeruke, C. (2020). China's Power in Africa. Springer International Publishing.

Alden, C. (2017). China and Africa. In Routledge Handbook of African Politics (pp. 414-425). Routledge.

Maurin, C., & Yeophantong, P. (2013). Going global responsibly? China's strategies towards “sustainable” overseas investments. Pacific Affairs, 86(2), 281-303.