Dumor, K(Dumor, Koffi);Zhao, SR(Zhao, Shurong);Dumor, HK(Dumor, Hafez Komla);Ampaw, EM(Ampaw, Enock Mintah);Amouzou, EK(Amouzou, Edem Koffi);OkaeAdjei, S(Okae-Adjei, Samuel);Boadi, EK(Boadi, Eric Kofi)

ABSTRACT:This study employs the new panel data structural gravity approach to investigate the overarching effect of ICT on bilateral trade flows and economic growth, by using a panel of 65 Belt and Road initiative (BRI) countries. This comprises of twenty-seven (27) sub-Saharan African countries from the period 2000 to 2019. The empirical results indicate that greater access to ICT deepens bilateral export and growth among participating countries. Essentially, the results demonstrate a positive correlation between ICT growth and economic development in the BRI countries. Overall, the findings reveal that ICT and infrastructural growth have provided the East African Community (EAC) a lot of opportunities to boost intra-regional trade. However, the BRI countries need to invest more heavily in ICT infrastructure to foster a continuous and sustainable economic development paradigm within the enclave.

KEYWORDS: ICT;bilateral trade;panel structural gravity model;East African Community (EAC)belt and road initiative (BRI) countries

Introduction

In recent years, the positive impact of Information and Communications Technology (ICT) on socio-economic growth and development has been widely acknowledged in diverse areas. Among the BRI participated countries, the East African countries hold a strategic position due to their geographical locations along the BRI road corridor. However, despite these insights, the future impact of ICT remains uncertain, emphasizing the need for further research in the field of ICT’s role in trade and economic development.

From the foregoing, the present study seeks to make at least two contributions to literature.

Methodologically, a more robust concept – the structural gravity equation , is used to obtain the estimates of the potential trade and growth effects of ICT across the BRI countries, particularly East African countries. Second, the present study contributes to the stream of literature on the effects of BRI-related ICT infrastructure on trade and growth .

Literature review

This section involves a brief review of related literature. Basically, this was done under three thematic areas, namely, the landscape of ICT in East Africa, the effect of ICT on economic growth and trade, and the relationship between trade and economic growth.Therefore, the combination of ICT and trade is expected to have a significant influence on both trade and economic expansion.

This paper makes the following two hypothesis:

H1. There is a significant positive effect of ICT on trade and economic growth in the BRI participating economies.

H2. There is a significant positive impact of ICT on trade and economic growth in the EAC members.

Methodology

The gravity model is the main method of international trade theory and empirical analysis. This study uses pseudo-Poisson maximum likelihood (PPML) and fixed-effect gravity models to investigate the impact of ICT on trade and growth in East Africa under the Belt and Road Initiative.

The structural panel data gravity model with fixed-effects

The econometrics panel for estimating the structural gravity equation is applied to solve the problem. In the data set, economic integration agreements guarantee non-discrimination in trade policies.

The structural gravity model

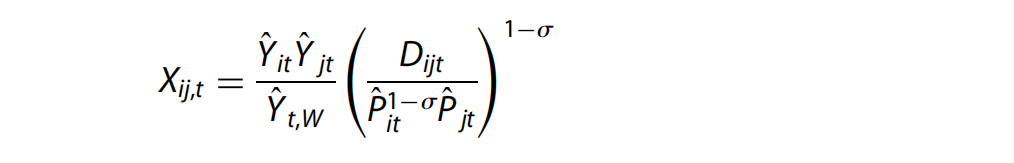

A panel frame is used for the cross-sectional Settings observed for C countries over T periods, and bilateral trade flows are assumed to produce the following:

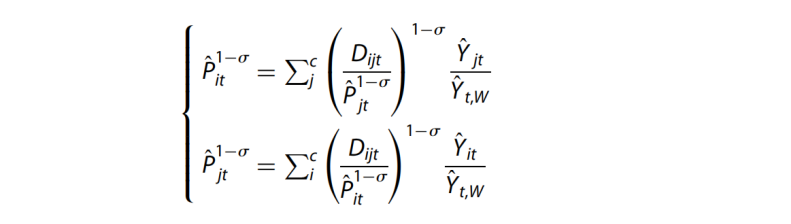

Where Xijt refers to bilateral trade volumes from exporting I to importing j at period t. Yit refers to the totality of production in exporter i. Yjt refers to the value of total expenditure(production) in importer j. Yt,W denotes overall (world) output or production. Dijt captures the trade cost or any trade frictions among exporting country i and its importing partner j, notably geographical distance between pair of countries, regional trade agreements, and other country-specific determinants of international trade. And σ indicates the elasticity of substitution for all products from various exporting (and importing) countries. Finally, Pit and Pjt respectively denote the structural outward and inward multi- lateral resistance (MR) developed by Anderson and Wincoop (2003). These conditions of resistance to remoteness trade are defined as follows:

The multilateral resistance (MR) terms defined in equation (2) by Anderson and Wincoop (2003) illus- trate the importance of a country’s remoteness factor from any part of the globe and its trade flows against other associates.

Data description and source

This data set includes 83,200 bilateral exporting countries (65×64 countries), based on data from the International Monetary Fund's Trade Statistics Bureau. By using Stata15.1 and the PPML command, we adopt a PPML model with a high-dimensional fixed effect set (Zylkin,2018). According to the data, East Africa performs poorly in terms of the quality of ICT infrastructure.

Econometric specification

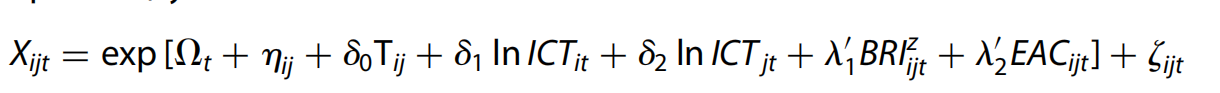

The specification of the structural gravity model follows. We defined BRIijt as a dummy variable which equals to 1 in time t if both trading members i and j were involved in the same BRIz and 0, otherwise as our main regressor of interest.Furthermore, we introduced the ICT index indicator variable. The EACijt indicator was incorporated to find out if the EAC members are relevant for bilateral trade under the BRI. It comprises of three (3) distinct dummies whose coefficients are the primary focus of this study. The first EAC_Intraijt dummy depicts ICT intra EAC trade and takes the value of 1 if both nations in the pair-associate with the BRI-members, otherwise 0. Its coefficient is positively projected. This indicates that members at both side of the trading divide within the EAC increase their economic exchange among themselves. The second dummy (EAC_Xijt) measures the impact of exports on non-partners of the EAC. It takes the value of 1 if the exporting nation is a member of the EAC, otherwise 0. The third dummy (EAC_Mijt) measures the effect of imports from non-partners of EAC members. It takes the value of 1 if only the importing nation is EAC partner otherwise 0. Thus, we transformed the chosen specification of Nguyen (2019b), whose novel OLS system has been penciled to have three-way fixed effects in the form of our ideal option of PPML.This shows that the economic exchanges between the members of both sides of the trade differences within ASEAN are increasing.

This paper uses the same gravity model and removes the year of importer and exporter from the publicity. The import and export impact of trade agreements on intra-group and non-group trade can be assessed. The following gravity model specifications are estimated:

Here, Ωt reflects the year effect of rising yearly patterns and shocks. With regard to the additional variables of the BRI, BRIz Xijt assumes the value of 1 if the exporting country i belongs to the BRI and the importing country j does not contribute in time t, and 0 otherwise. This dummy variable conveys the export effect on the rest of the world. If the importing country j belongs to the BRI, the variable BRIz_Mijt takes 1, otherwise, it is zero, and the exporting country i does not involve time t. This dummy variable tests the effect of group imports from other parts of the world.

Main results and discussion

Standard model examining the effects of ICT on trade-blocs

The results show that: (1) the trade volume will increase by 2.51% for every 10% increase in ICT quantity of exporting country. (2) The GDP coefficient of exporting country (importing country) is significantly positively correlated at 5%, indicating that the GDP of exporting country and importing country has a significant and strong influence on export flow. (3) The geographical distance coefficient is significantly negatively correlated at 5%, which indicates that there is an inverse relationship between bilateral geographical distance and bilateral trade. In the long run, in the context of the Belt and Road Initiative, exports can increase with the improvement of countries' infrastructure levels. (4) There is a positive correlation between proximity and common language coefficient, that is, the trade flow among the members of regional trade agreement is affected by language commonality and proximity.

From the perspective of studying the impact of ICT on bilateral trade of Belt and Road participating countries (especially the East African Belt and Road member countries) : (1) The coefficient of the BRI dummy variable is significantly positively correlated at 5%, suggesting that member states should enhance their interest in international trade by promoting and encouraging the use of ICTs as a strategy to boost exports, growth and development (Nath and Liu,2017). (2) The coefficient ijt of BRI is also positively correlated at 5% of the variable, indicating that the Belt and Road Initiative has a positive impact on regional trade. (3) In addition, the BRI_Xijt variable coefficient has a significant negative correlation, indicating that export trade is abused. (4) The BRI_Mijt coefficient is significantly positive, which means that Belt and Road importers are shifting their business to non-member countries.

ICT effect on Eastern African countries

The results show that: (1) After the signing of multiple regional trade agreements, the trade between member countries presents an upward trend. (2) The impact of extragroup regional trade agreements is different. (3) The impact of regional trade agreements on foreign trade is significant both in export and import. (4) There are no conflicting signs of RTA, that is, the impact of import formation will not affect export diversion. (5) When PPML estimates are used to explain zero trade flows, the ICT impact estimates of EAC trade agreements under the Belt and Road Initiative are consistent with previous literature.

Robustness checks and extension

Table 3 presents the estimated Generalized Linear Model (GLM)-Poisson Pseudo Maximum Likeli-hood (PPML) of economic integration impact on the BRI from various robustness checks as proposed by Egger et al. (2011), Egger and Staub (2016), Camarero et al. (2020). This brings finality to the Gamma-PPML(GPML), and Negative Binomial PPML (NBPML) estimation under the fixed effects models. The first two columns (5–6) of the results in Table 3 reiterate Table 2 findings to make comparison easier.

Overall, results in columns (5–10) of Table 3 are consistent with our previous findings. These results also corroborate the fact that there is a significant positive effect of economic integration,ICT infrastructure, and trade frictions factors on bilateral exports. These findings confirm the results in extant literature (Luong & Thu Hang, 2020; Maneejuk & Yamaka, 2020; Myovella et al.,2020). Besides, there is evidence of the positive impact of the BRI on intra-blocs trade, including the EAC.

Conclusions

The findings of our study demonstrate that ICT infrastructure has a positive effect on bilateral exports among all the BRI participating countries, especially in Eastern African exporting countries. These results were obtained from econometric specifications. It contains comprehensive parameters that control geographical distance, trade frictions, BRI dummy, and EAC. We also found that the effect of ICT is different from the role played by RTAs formation. In particular, we observed a significant positive effect of ICT on intra-bloc trade, including the EAC members who are part of the BRI as specified in previous studies (Appiah-Otoo & Song,2021; Iqbal et al., 2020; Wang et al., 2020).

Policy significance:

The findings of this study have important policy implications. Specifically, the results highlight that China’s BRI ICT investment could promote bilateral trade flows and facilitate economic growth in the least developed countries. Thus, the results will be informative and handy for policy-makers. In other words, our results highlighted the importance of ICT and trade-promoting policies among the participating economies of East Africa and the ability of the BRI to promote East African growth from a win-win perspective.

policy proposal:

First, the Eastern Africa Community Partner States and the remaining partners of BRI especially, those in Africa (due to their socio-economic commonalities with the EAC) should initiate policies that have the proclivity and inclination to increase the volume of investment in ICT infrastructure astronomically for optimal benefit.

Second, the participating countries of EAC and the rest of African countries should endeavor to promote trade to lessen bottlenecks through risk-based methods to border management, recent information, and communication technology processes with re-engineered and simplified practices,among others.

Third, there is also the need for the partners of BRI in Africa to lessen trade barriers policy in some service areas such as transportation, and move toward the identification of trade agreements that would sustain BRI investment (including policy areas such as investment and public procurement). Further studies on the significance of gains each member state would obtain from the EAC’s ICT and trade policy initiatives should be undertaken to engage the regions in a more informative way and eliminate any fear of development.

Lastly, some of the problems that have inundated the ICT sector in Africa as a whole are low levels of digital technology literacy, Internet penetration, and cyber fraud. To address these challenges, policymakers and service providers could embark on a sensitization campaign on ICT via the informal educational system in both urban and rural communities to adequately apprise the folks with the applications of mobile apps and services. Also, the formal educational sector can be equipped to teach ICT seamlessly by providing it with the prerequisite logistics and human resources. The instructional hours on the teaching of ICT should also be increased.