The West African nation of Benin, known as Africa's leading cotton producer, is making significant strides in developing its home-grown textile industry. With an annual cotton production of 728,000 tons in the 2020/21 season, Benin has primarily exported this raw material, predominantly to Bangladesh. However, a new initiative aims to transform this dynamic by processing the cotton locally to create apparel for export to markets in Europe, Asia, Africa, and the United States.

This initiative is centered around the Glo-Djigbe Industrial Zone (GDIZ), located approximately 45 kilometers from Cotonou. GDIZ, established through a collaboration between the Beninese government and Arise Integrated Industrial Platforms (Arise IIP), a pan-African venture partially owned by the Africa Finance Corporation, represents a concerted effort to boost local employment and revenue by fostering a domestic textile sector. The industrial zone is a bustling hub where young workers are engaged in the cutting, stitching, and assembly of cotton shirts, marking the beginning of Benin's transition from a raw cotton exporter to a textile manufacturing hub.

Letondji Beheton, the managing director of GDIZ, emphasized the country’s new direction, stating, "We have decided that in this country, we are no longer going to sell this cotton raw. We are going to transform this cotton, in particular by installing integrated textile factories."

This strategic shift not only aims to add value to the country's primary agricultural export but also to create numerous job opportunities and stimulate economic growth within Benin.

[1/6] People work at a shirt-making factory in the Glo-Djigbe Industrial Zone (GDIZ) in Abomey-Calavi, Benin October 13, 2022. REUTERS/Coffi Seraphin Zounyekpe Purchase Licensing Rights

[2/6] GDIZ started two years ago as the result of a partnership between the government and Arise Integrated Industrial Platforms (Arise IIP), a pan-African venture partly owned by the Africa Finance Corporation.

[3/6] People work at a shirt-making factory in the Glo-Djigbe Industrial Zone (GDIZ) in Abomey-Calavi, Benin October 13, 2022. REUTERS/Coffi Seraphin Zounyekpe Purchase Licensing Rights

More than $1 billion has been invested in the zone so far, which will include textile factories as well as cashew processing units, pharmaceutical processing units, and more, said Beheton. Only a quarter of it has been developed so far.

Although the systems are not yet in place to get cotton from field to factory, GDIZ has started training about 1,000 garment workers using imported materials for now.

"When the Glo-Djigbe factory starts its activities, I am sure that we will earn more," said 46-year-old cotton farmer Leonard Madjaedou, who has benefited from government support to boost his yields.

In 13 months, the industrial zone aims to employ 15,000 people in three textile factories that will have a processing capacity of about 40,000 tonnes of cotton fiber, Beheton said.

Eventually, he envisages a multi-billion-dollar industry that could process the majority of Benin's cotton.

Cotton is grown in several West African countries including Mali, Togo, Burkina Faso, and Ivory Coast, but most is exported raw with little industrial processing across the region.

Benin: Africa’s Leading Cotton Producer

Rapid Growth in Cotton Production

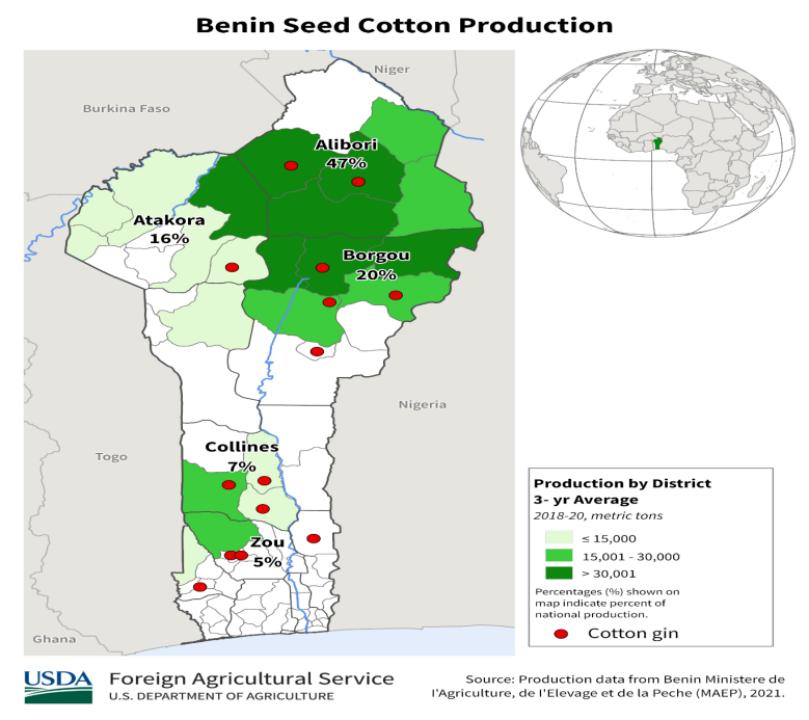

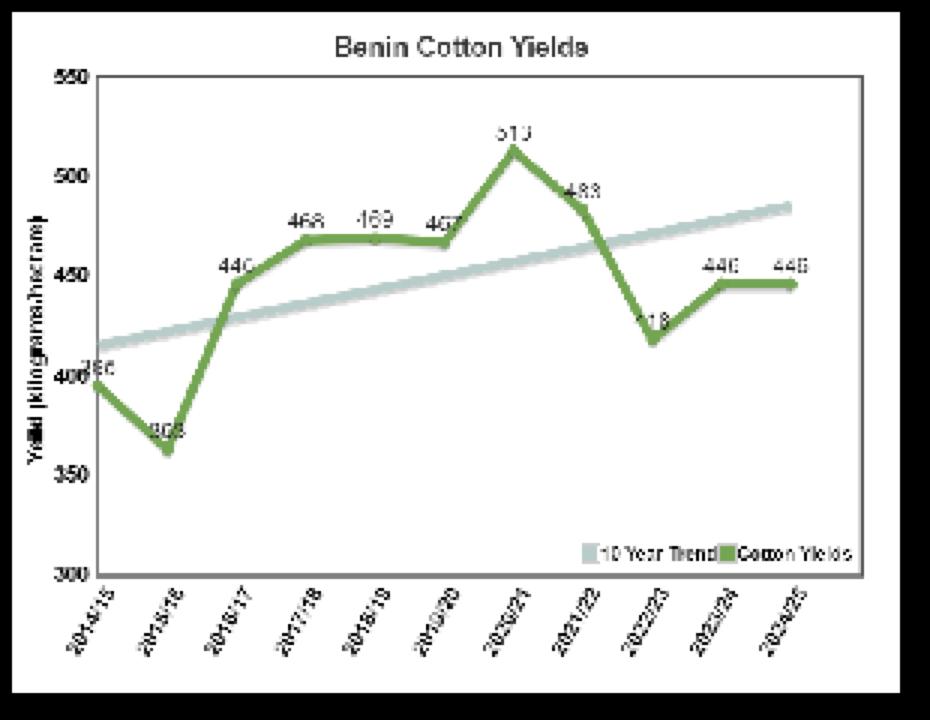

From 2017 to 2019, Benin's cotton production increased by 13.4%, reaching a record 678,000.3 tonnes during the 2018-2019 crop year, up from 597,573.2 tonnes in the 2017-2018 crop year. This significant performance positioned Benin as Africa's leading cotton producer. The forecast for the 2019-2020 crop year further projected an increase to 732,273 tons.

Figure from https://ipad.fas.usda.gov/countrysummary/Default.aspx?id=DM&crop=Cotton

· Solid Economic Performance

Agriculture remains the backbone of Benin's economy, which has seen remarkable improvements in recent years. The country's economic growth rate reached 6.9% in 2019, up from 6.7% in 2018.

Figure from https://ipad.fas.usda.gov/countrysummary/Default.aspx?id=DM&crop=Cotton

Key contributors to this growth include:

· Agricultural Production: Excellent performance in cotton and food crops.

Construction Sector: Increased activity and investments.

Agro-Industry Sector: Favorable developments and expansions.

Energy Supply: Enhanced electricity supply.

Port of Cotonou: Increased dynamism boosting transport activity.

Public Revenue Mobilization: Strengthened efficiency of financial authorities.

These factors, alongside the diversification of export channels and a dynamic services sector, have played crucial roles in bolstering Benin's economy.

Successful Economic Reforms

Economic reforms implemented over the past few years have been pivotal in driving growth. Although the GDP growth rate was expected to slow to 3.5% in 2020 due to the COVID-19 pandemic, the primary sector still recorded growth of 5.2% in 2019. This was driven by increases in food production, significant cotton production, and contributions from ginning activities.

The secondary sector also saw robust growth, with a 13.6% increase in 2019, up from 4.8% in 2018. This growth was supported by:

· Construction Activity: Continued strengthening.

Agrifood Industries: Dynamic performance.

Energy Sector: Expansion with the launch of the Maria-Gléta 2 power plant in August 2019, part of the Government Action Program (PAG) 2016-2021, adding a 127 MW capacity.

Tertiary Sector and Investment

The tertiary sector grew by 5.2% in 2019, driven by strong performances in telecommunications, hotels, restaurants, and other services. Additionally, the number of new company registrations significantly increased, with over 19,200 national and foreign companies registered between January and August 2019, according to the Investment and Export Promotion Agency (APIEX).

Economic Impact of COVID-19

The economic impact of the COVID-19 pandemic led to an expected widening of the budget deficit to 3.5% of GDP in 2020, compared to 0.5% in 2019, due to lower revenues, higher health expenditures, and economic support measures. Public debt was projected to rise to 42.6% of GDP in 2020.

Positive Economic Outlook

Despite the challenges posed by the pandemic, Benin’s economic performance over the past three years has been remarkable, with a positive outlook for the future. This is supported by:

Long-term Investment Grade Rating: A- by Bloomfield.

Development Plans: Ongoing ten-year development plans, including the strategic plan for the development of the agricultural sector (2017-2025) and the national agricultural, food security, and nutrition investment plan (2017-2021).

Agricultural Development Poles: Promotion and extension of cotton, rice, cassava, pineapple, maize, and cashew sub-sectors.

· Recognition and Business Environment

Thanks to the economic reforms, Benin has improved its ranking in the Doing Business 2020 index to 149th out of 190 countries, an improvement of four ranks from the previous period.

For a more detailed understanding of Benin’s economy and investment prospects, download the Benin information note from UMOA-Titres, 2020 edition.

Reference:

Kütting, G. (2003). Globalization, poverty and the environment in West Africa: too poor to pollute. Global Environmental Politics, 3(4), 42-60.

https://www.theguardian.com/global-development/2023/mar/21/cutting-its-cloth-can-plans-for-a-new-industrial-revolution-transform-benins-economy

Bassett, T. J. (2006). The peasant cotton revolution in West Africa: Côte d'Ivoire, 1880-1995 (Vol. 101). Cambridge University Press.

Toye, A. O. (2021). China-Africa Relations: The Northern Nigerian Textile Industry (Master's thesis, Chapman University).

Acquaye, R., Amankwah, A. M., & Seidu, R. K. (2024). The “Authenticity Discourse” in Contemporary Application of West African Textiles. TEXTILE, 22(1), 218-232.

Sall, L. M., Odjo, S. P., & Zaki, C. (2023). Competitiveness of the cotton value chain in Africa.

African Union Commission. (2023). Investing in agri-food value chains for West Africa’s sustainable development