Blockchain Technology for Land Tenure Security and Agricultural Financing in Rural Nigeria and Benin

Dr. Lucy Anning

Center for West African Studies of UESTC

University of Johannesburg

West Africa.

1. Introduction

In an age of digital transformation, blockchain emerges as a revolutionary force, poised to resolve long-standing challenges in land administration and agricultural financing. Despite its potential, its adoption in rural economies remains largely untapped (Christodoulou et al., 2024). In Nigeria and Benin, land tenure insecurity and limited credit access continue to stifle economic progress, the very issues blockchain can decisively address.

Land ownership disputes and weak institutional frameworks prevent farmers from leveraging their land for credit, perpetuating financial exclusion. With nearly 60% of land in sub-Saharan Africa lacking formal registration, blockchain’s tamper-proof ledger offers a game-changing solution by ensuring secure, verifiable land records.

Moreover, smart contracts streamline loan disbursements, eliminating intermediaries and reducing financial risks. Inspired by successful cases on the globish arena including Ghana, Georgia and Sweden, this article delves into blockchain’s potential to enhance land security, unlock credit access, and fuel rural development in Nigeria and Benin.

2. Delving into Blockchain's Potential to Resolve Land Ownership Disputes Amidst Case Studies

Land ownership disputes in rural Nigeria and Benin remain a significant obstacle to economic development, perpetuating cycles of poverty and social tension. In these regions, land is not only a vital agricultural asset but also a cornerstone of identity and inheritance. However, the combination of historical grievances, informal land tenure systems, overlapping ownership claims, and inadequate documentation has led to persistent conflicts. According to the World Bank, approximately 90% of rural land in sub-Saharan Africa, including Nigeria and Benin, lacks formal registration, making it prone to disputes and expropriation (Mohamed et al., 2024). The situation is further complicated by corruption, inefficiencies in land administration, and conflicting customary and statutory laws, which deter investment and undermine sustainable land use. These disputes lead to forced evictions, diminished agricultural productivity, and increased social unrest. To address these challenges, a transparent, tamper-proof system is needed to ensure land tenure security and build trust in land transactions.

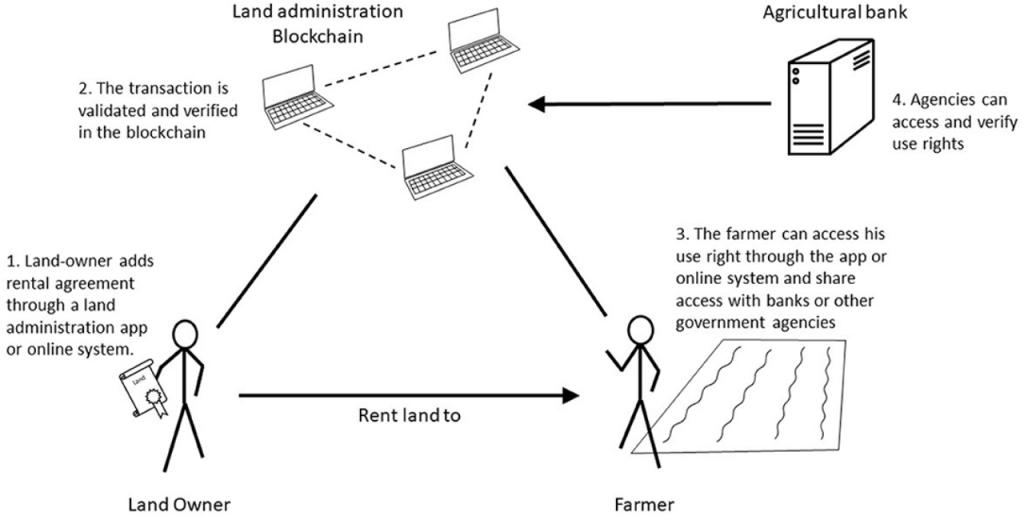

Blockchain technology, in accordance with the findings of Mansour & Moustafa (2021), with its decentralized and immutable ledger system, offers a revolutionary solution to these problems. By providing a secure, transparent, and time-stamped record of land transactions, blockchain eliminates fraudulent claims and unauthorized alterations. Smart contracts further enhance the process by automating land agreements, reducing reliance on intermediaries and minimizing disputes (Kumar & Singh, 2021). Blockchain’s transparency allows stakeholders such as landowners, government agencies, and financial institutions to access verifiable, tamper-proof records, fostering trust and enabling efficient land transactions. This innovation could pave the way for a more stable, investment-friendly rural economy in Nigeria and Benin.

Successful case studies from countries like Sweden, Georgia, and Ghana demonstrate blockchain’s efficacy in resolving land ownership disputes. For instance, Sweden's Lantmäteriet agency has reduced processing time from months to weeks (Mohamed, Haddad & Barakat, 2024), and Georgia's National Agency of Public Registry has digitized land records, significantly reducing fraudulent claims (Zhang & Wang, 2019). Similarly, Ghana's Bitland initiative is using blockchain to authenticate land ownership, mitigating conflicts in informal land tenure systems.

Despite blockchain’s potential, there are challenges, including inadequate infrastructure, resistance from traditional authorities, and limited digital literacy in rural areas. Addressing these barriers requires collaboration among policymakers, technology providers, and local communities. If successfully implemented, blockchain technology could redefine land administration in these regions, promoting economic stability, social cohesion, and sustainable development.

3. Blockchain's Potential in Credit Access for Smallholder Farmers in Nigeria

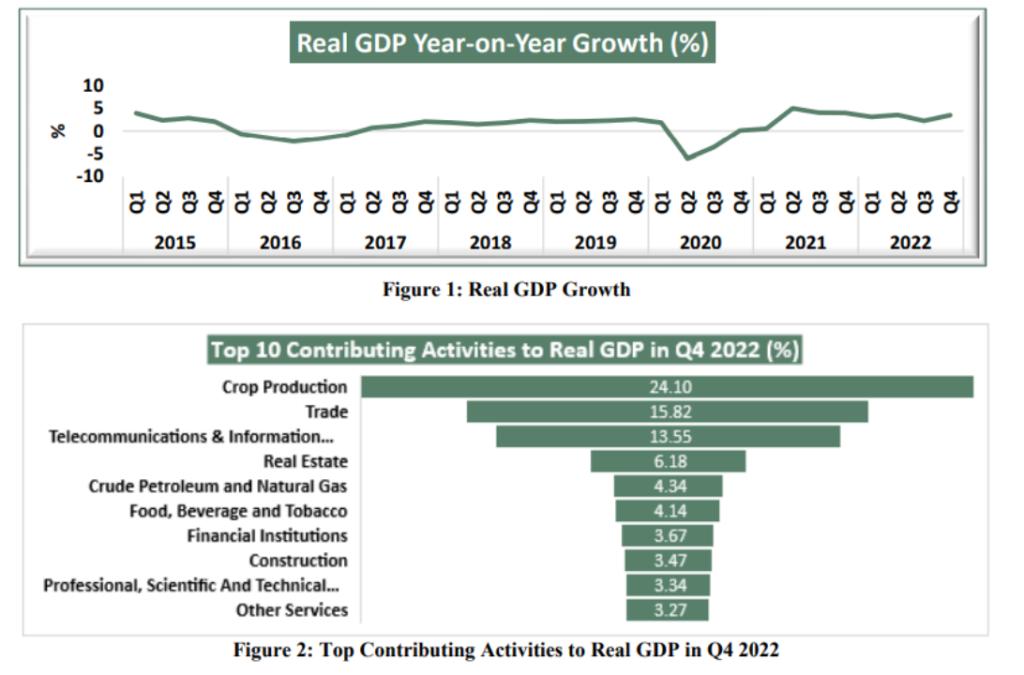

According to the World Bank (2022) report, agriculture remains the backbone in the Nigerian economy, employing over 70% of the rural population and contributing approximately 23% to the country’s GDP. However, despite its importance, smallholder farmers face significant financial exclusion. Limited access to formal credit markets prevents them from investing in quality seeds, modern equipment, and sustainable farming practices. Traditional lending institutions often require collateral and extensive documentation, which most farmers lack. As a result, many rely on informal lenders with high interest rates, perpetuating cycles of poverty and low productivity (Sanusi et al., 2025).

Blockchain technology offers an innovative solution to these barriers. By creating verifiable digital identities and credit histories through blockchain's decentralized system, smallholder farmers can build trust with financial institutions. This transparency allows lenders to more accurately assess creditworthiness and extend loans to previously underserved farmers. Furthermore, blockchain’s smart contracts can automate loan disbursements and repayments, reducing costs and minimizing default risks.

Global case studies, such as Kenya's Agriledger and Ghana’s Bitland project, showcase blockchain’s effectiveness in agricultural financing, helping farmers access credit and improve productivity (Zhang & Wang, 2019; Mansour & Moustafa, 2021). Despite challenges like infrastructure deficits and low digital literacy, blockchain has the potential to revolutionize agricultural financing in Nigeria, empowering farmers, boosting productivity, and fostering economic growth in rural communities.

4. Blockchain as a Game Changer for Credit Access in Rural Benin

In the vibrant agricultural landscapes of Benin, smallholder farmers have long been the backbone of the nation's food security. Yet, their growth has been stymied by limited access to credit, a challenge that perpetuates cycles of low productivity and poverty (Mekonnen et al., 2024). Blockchain’s decentralized and transparent nature addresses trust deficits in rural financial transactions. By recording data on an immutable ledger, it enhances integrity and enables the creation of digital identities and credit histories for farmers. As a result, banks and microfinance institutions can assess creditworthiness more accurately, reducing fraud risks and encouraging lending. Additionally, blockchain facilitates asset tokenization, allowing farmers to use digital tokens backed by stored crops as collateral. This provides immediate liquidity and enables them to sell produce at optimal market conditions, maximizing income.

Integrating blockchain into digital platforms in Benin could enhance financial inclusion, building on initiatives like the Benin Digital Rural Transformation Project while mobile-compatible blockchain solutions are most likely to ensure accessibility, empowering smallholder farmers and fostering economic growth.

Ultimately, blockchain technology holds transformative potential for enhancing credit access among smallholder farmers in Benin. By fostering trust, enabling asset tokenization, and leveraging existing mobile infrastructure, blockchain paves the way for a more inclusive and prosperous agricultural sector. As these digital innovations take root, they promise to uplift the very farmers who nourish the nation, ushering in an era of growth and sustainability.

5. Analysis of Key Variables and Their Interconnection in Enhancing Land Tenure Security and Agricultural Financing in Rural Nigeria and Benin

In rural Nigeria and Benin, the integration of blockchain technology, land tenure security, and agricultural financing has the potential to drive socio-economic development. Secure land tenure is essential for sustainable agriculture, as it empowers farmers to invest and improve productivity. However, traditional land registration systems in Sub-Saharan Africa face challenges, such as inefficiency and lack of transparency. Blockchain technology offers a solution by providing a decentralized and tamper-proof ledger for land records, reducing ownership disputes and streamlining land registration processes. This, in turn, enables farmers to use their land as collateral for credit, boosting access to financing for modern farming practices and technology. Additionally, blockchain's transparency can improve the monitoring of agricultural agreements. In Nigeria, where land tenure issues and limited financing hinder agricultural progress, blockchain can significantly enhance land security and financing. This synergy can transform agriculture, fostering productivity, economic empowerment, and sustainable development in these regions.

6. Conclusion

In essence, the integration of blockchain technology into land tenure systems and agricultural financing mechanisms in rural Nigeria and Benin represents a transformative approach to sustainable development. By ensuring transparent and immutable land records, blockchain enhances land tenure security, thereby empowering farmers to invest more confidently in their agricultural activities. This technological advancement not only facilitates access to financing but also promotes the adoption of modern farming techniques, leading to increased productivity. Consequently, this triad of blockchain technology, secure land tenure, and robust agricultural financing serves as a catalyst for economic growth and poverty alleviation in these rural communities. Embracing this innovative convergence paves the way for a more prosperous and food-secure future in the region.

References

1) Ansenberg, U. (2025). Mediating urban realities: the role of real-estate appraisers in dismantling the Musha'a system. City, 1-24.

2) Christodoulou, I., Rizomyliotis, I., Konstantoulaki, K., Nazarian, A. and Binh, D., 2024. Transforming the remittance industry: harnessing the power of blockchain technology. Journal of Enterprise Information Management, 37(5), pp.1551-1577.

3) Kumar, A., & Singh, R. (2021). Blockchain technology for agricultural financing: A review of applications and challenges. Agricultural Finance Review, 81(1), 1-18.

4) Mansour, M., & Moustafa, M. (2021). The role of blockchain technology in enhancing land tenure security: A systematic review. Land, 10(3), 1-18.

5) Mekonnen, S. A., Jalata, D. D., & Onyeaka, H. (2024). Building resilience in Sub‐Saharan Africa's food systems: Diversification, traceability, capacity building and technology for overcoming challenges. Food and Energy Security, 13(4), e563.

6) Mohamed, S. K., Haddad, S., & Barakat, M. (2024). Does blockchain adoption engender environmental sustainability? The mediating role of customer integration. Business Process Management Journal, 30(2), 558-585.

7) Sanusi, M. S., Mayokun, O. M., Sunmonu, M. O., Yerima, S., Mobolaji, D., & Olaoye, J. O. (2025). Transformative trends: commercial platforms revolutionizing rice farming in Nigeria's agricultural value chain. International Journal of Agricultural Sustainability, 23(1), 2473757.

8) Zhang, Y., & Wang, Y. (2019). Blockchain technology in agriculture: A review of applications and challenges. Computers and Electronics in Agriculture, 162, 1-10.

9) World Bank (2022). Helping Countries Adapt to a Changing World. Retrieved from https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099030009272214630/bosib0db37c9aa05a0961a08a83a0ea76ea